Porter’s Five Forces

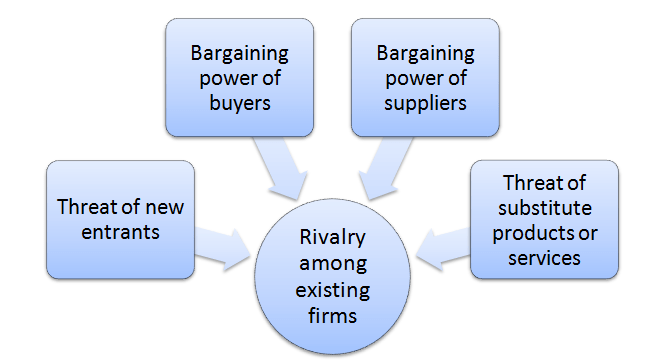

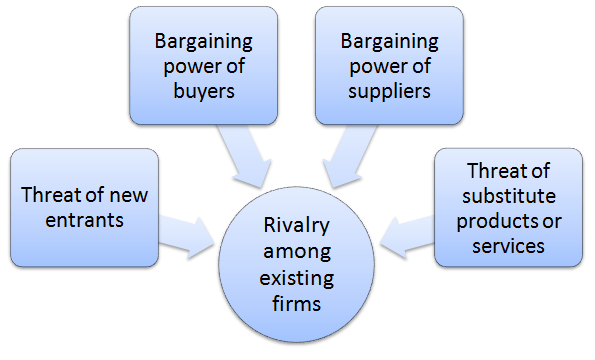

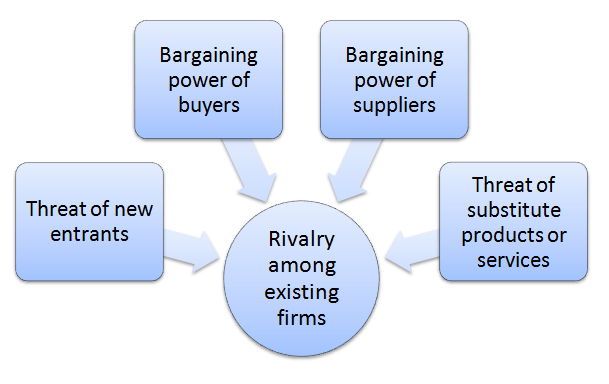

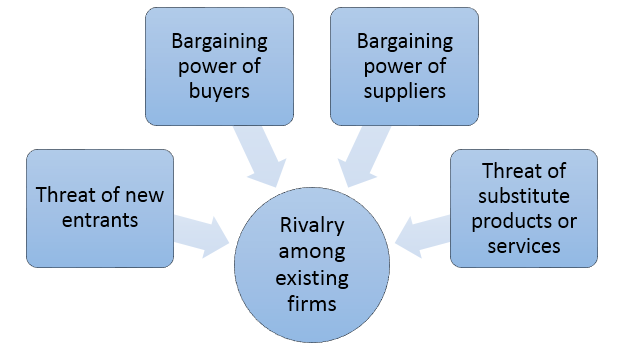

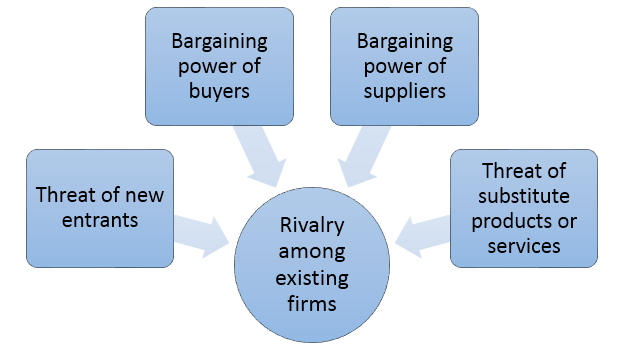

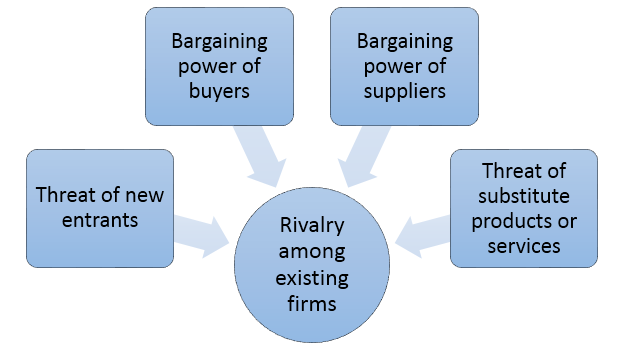

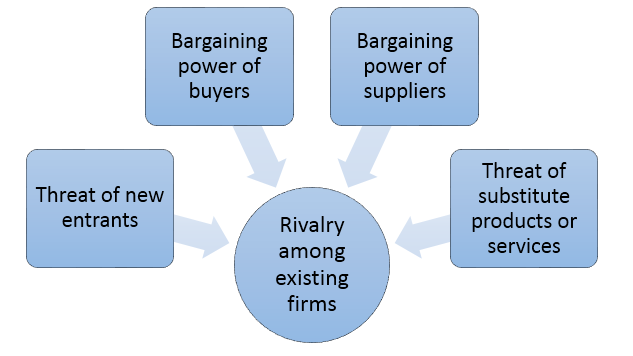

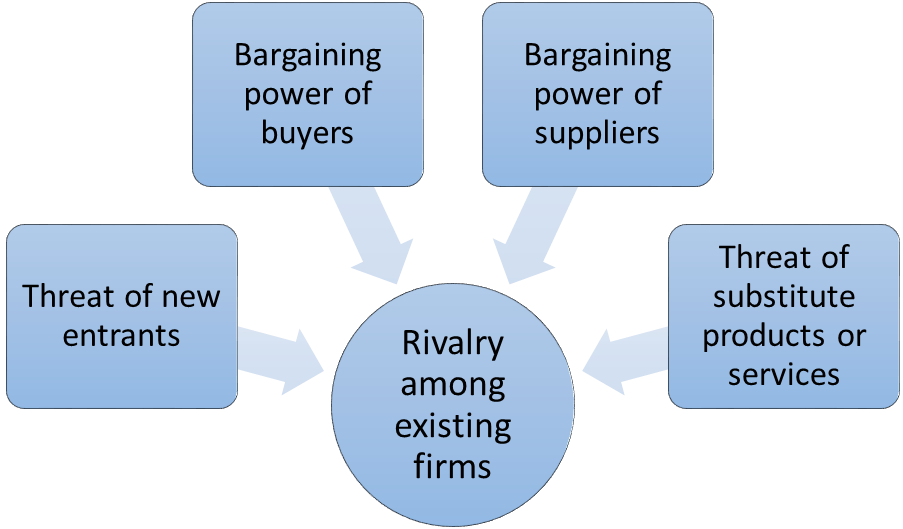

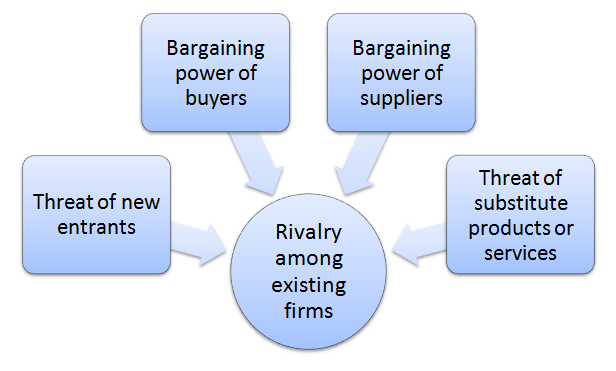

Gap Inc. Porter’s Five Forces analysis includes a critical analysis of five separate forces that shape the overall extent of competition in fashion, apparel and accessories industry. Developed by Michael Porter (1979)[1], five forces analysis remains as one of the most important strategic analytical tools for competitive analysis for more than three decades. Figure 1 below illustrates the essence of Porter’s Five Forces. Figure 1 Gap Inc. Porter’s Five Forces Rivalry among existing firms clothing and accessories industry is fierce. Gap Inc.’s major competitors include Abercrombie & Fitch Co., American Eagle Outfitters, Inc., Belk, Inc., Guess, Inc., J. C. Penney Company, Inc., J.Crew Group, Inc., Michael Kors Holdings Ltd, Urban Outfitters, Inc., Williams-Sonoma, Inc. and others. It is important to note that “despite being one of the bigger apparel players in the U.S., Gap Inc. holds less than 5% market share, which clearly indicates the diverse nature of the U.S. apparel industry. Higher shares are held by multi-brand retail chain Macy’s (9%) and general merchandise retailer Wal-Mart (over 7%). J.C. Penney (3.3%) and Target (5.4%) also hold a similar portion of the market, and American Eagle Outfitters, Aeropostale and Abercrombie & Fitch together account for just over 2% of total U.S. apparel sales.”[2] The figure 2 below illustrates a rough pattern of retail landscape in the US. Figure 2 Apparel market share in the US Bargaining power of Gap Inc. suppliers is low. The company purchases from about 1000 suppliers with factories in about 40 countries. Gap’s two largest vendors each accounted for only about 5 percent of the dollar amount of its total fiscal 2015 purchases[3]. Accordingly, Gap Inc.’s business is not dependent on any particular supplier and this fact increases its bargaining power in dealing with supplies. Furthermore, for the majority of suppliers it is critically important to have business with Gap Inc. due to the high volume of…

eBay Porter’s Five Forces is an analytical model that explains five individual forces shaping an overall extent of competition in e-commerce industry. These forces are represented in Figure 1 below: Figure 1 eBay Porter’s Five Forces Threat of substitute products or services for each type of service offered by eBay is significant. eBay services can be divided into three categories: Marketplace, StubHub and Classified. A great range of supermarket chains such as Wal-Mart, Tesco, Target, Sainsbury’s and others represent a significant substitution for eBay Marketplace. Moreover, the presence of e-commerce sites of all large supermarket chains further increases the significance of this threat. eBay StubHub is a online place where customers can buy and sell tickets for sports, concerts, theatre and other live entertainment events. Substitute services for StubHub include, but not limited to offline ticket offices, online forums and websites selling tickets along with other types of products and services. For eBay Classifieds, substitute services relate to Yellow Pages and other similar print advertising mediums. Media advertising, as well as, advertising on a wide range of media platforms can also be mentioned as substitutes for eBay Classifieds. Rivalry among existing firms in industries where eBay operates is highly intensive. This is primarily due to the impressive rate of industry growth and increasing numbers of competitors operating in the industry. eBay competes with a wide range of retailers, distributors, liquidators, import and export companies, auctioneers, catalogue and mail order companies, classifieds, directories, search engines, commerce participants (consumer-to-consumer, business-to-consumer and business-to-business), shopping channels and networks. eBay’s major competitors include Amazon Inc., Alphabet Inc, Alibaba, Yahoo Inc., Best Buy Co. Inc., Target Corporation, Chemours Co., Family Dollar Stores Inc., Staples Inc., Priceline Group Inc. and others. As it is illustrated in Figure 2 below, the number of eBay active users has been consistently…

The analytical framework of Porter’s Five Forces developed by Michael Porter (1979)[1] explains five separate forces that shape the overall extent of competition in the industry. These forces are represented in Figure 1 below: Figure 1. Hilton Porter’s Five Forces Rivalry among existing firms in premium segment hotel industry is fierce. Hilton Hotels and Resorts competes with Marriott, Sheraton, Hyatt Regency, Radisson Blu, Renaissance, Westin, Sofitel and other premium segment hotel chains in the global marketplace. As a result of massive investments into various aspects of the service provision during the past few years, Hilton enjoyed greater income growths compared to the competition. Specifically, as it is illustrated in Figure 2 below, Hilton Worldwide Holdings Inc. Net Income in the 1 quarter 2016 grew year on year by 106.67 %, faster than average growth of its competitors. Figure 2. Income growth differences between Hilton Worldwide and its competitors[1] Bargaining power of Hilton suppliers is low. Hilton Worldwide purchases from more than 4000 suppliers globally [2] and the bargaining power of most suppliers is low due to the lack of uniqueness of products and services supplied. Moreover, the importance of order volume for Hilton suppliers is paramount and there is no supplier switching costs for Hilton on most cases. Hilton runs Supplier Diversity Program that ensures purchasing from, and the development of, socially diverse suppliers. Accordingly, the program provides an additional competitive ground for socially diverse suppliers compared to other supplier groups. Threat of substitute products or services in hotel industry is not significant. Direct substitutes for staying in Hilton hotels includes people staying in the homes of friends and relatives and people renting apartments for short periods of time. However, arrangement of these options can be time-consuming and associated with a great deal of hassle. Hotel industry is also faced with…

Red Bull Porter’s Five Forces identifies and analyses five separate forces that determine the overall pattern of competition in the energy drinks sector. These forces are represented in Figure 1 below: Figure 1 Red Bull Porter’s Five Forces Threat of substitute products or services is immense. Coffee is an obvious and cheaper substitute for energy drinks. Carbonated soft drinks, tea, water and juices represent additional substitute products. It is important to stress that buyer’s propensity to choose certain substitute products such as tea, water and juices may increase in the foreseeable future due to due to their increasing health-considerations fuelled by the media. There are no switching costs for customers to consume substitute products instead of energy drinks and this fact further increases the threat of substitute products. Indirect substitutions for energy drinks include getting enough sleep and leading a balanced life and this comes free of charge for the majority of customers. Rivalry among existing firms in energy drink industry is very intense. There are many energy drink brands and the rate of the growth of the industry is impressive. It has to be noted that diversity of competitors is not significant and brand equity plays a major role on the level of popularity of a specific energy drinks manufacturer. Major market players in energy drinks sector include Red Bull, Monster, NOS, Rockstar, 5-hour energy, AMP, Redline, Lucozade and others. As it is illustrated in Figure 2 below, although Red Bull is a clear market leader in energy drink segment in the US, its share in the global soft drinks and energy drinks sector is only 6.7 per cent (see Figure 3 below). Figure 2 Market share of soft drinks and energy drinks worldwide as of 2015[1] Figure 3 Energy drink market share in the US[2] Threat of new…

British Airways Porter’s Five forces analysis is an analytical framework developed by Michael Porter (1979)[1]. The framework distinguishes between five individual forces that shape the overall extent of competition in the industry and studies them. These forces are represented in Figure 1 below: Figure 1 British Airways Porter’s Five Forces Threat of substitute services for an airline is not significant. It has to be clarified that although there is a substitution for air travel, represented by other modes of transportation such as vehicles and sea transports, air travel remains as the fastest form of travel. From this point of view, it can be argued that there is no substitution to airplanes to travel thousands of miles in a matter of few hours. At the same time, rapidly developing internet-based information and communication technologies represent indirect substitution for air travel. For example, an intensive development of communication technologies during the last decade presented the opportunities of real-life video conferencing, thus eliminating the necessity for long-distance travels for business and other meetings. Threat of new entrants into the airline industry is low. Major capital requirements is one of the most significant barriers for new market entrants. As it is illustrated in Figure 2 below, the cost of Boeing aircrafts, one of the most popular airplane brands, can reach USD 400 million and there are no aircraft from reputable manufacturers with a price tag of less than USD 70 million. Figure 2 Average prices for Boeing aircraft in 2015, by type (in million U.S. dollars)[2] Lack of access to distribution channels represents another significant barrier for new market entrants into the airline since. This is because it may prove to be difficult to find free slots and runways in the major international airports such as Heathrow Airport in UK and JFK airport in…

Tesco Porter’s five forces attempts to analyze five separate forces that determine the extent of overall competition in the grocery retail industry. These forces are represented in Figure 1 below: Figure 1 Tesco Porter’s Five Forces Threat of substitute products or services for Tesco is irrelevant. Tesco sells a wide range of products belonging to the following categories: Clothing & jewelry Technology & gaming Health & beauty Home electrical Entertainment & books Home appliances Baby & toddler Garden Toys DIY & Car The range of products sold by Tesco is highly comprehensive. The supermarket chain sells a wide range of products, as well as, substitutes of the majority of these products. Therefore, it can be argued that the threat of substitute products and services for Tesco is irrelevant. Rivalry among existing firms in supermarket chain sector is fierce. The amount of advertising expenditure and the extent of differentiation of products and services are major factors impacting the competitiveness of companies operating in food and grocery retail industry. There are no switching costs for consumers and this fact also increases the intensity of competition in the industry. As it is illustrated in Figure 2 below, although there are many major market players in the grocery retail industry in the UK, Tesco maintains a clear leadership position despite challenges the company currently faces. Figure 2 Market share of grocery retail chains in the UK from January 2015 to April 2016[1] Bargaining power of Tesco suppliers is low. Tesco has hundreds of suppliers and there is a minimum or no supplier switching cost for the supermarket chain. The company has the history of using its barraging power to delay payment to suppliers in order to improve its operational profit margins under the previous leadership in 2014.[2] After this and other incidents of poor…

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] focus upon five separate forces that shape the overall intensity of competition in the industry. These forces are represented in Figure 1 below: Figure 1. PepsiCo Porter’s Five Forces Bargaining power of PepsiCo suppliers is insignificant. The main ingredients used by PepsiCo to produce its beverages, food and snacks include apple, orange and pineapple juice and other juice concentrates, aspartame, corn, corn sweeteners, flavorings, flour, grapefruit and other fruits, oats, oranges, potatoes, raw milk, rice, seasonings, sucralose, sugar, vegetable and essential oils, and wheat [2] PepsiCo purchases from a large number of suppliers and the bargaining power of each individual supplier is low due to the lack of uniqueness of products supplied. Furthermore, high level of importance for each supplier to have business with PepsiCo and PepsiCo’s ability to switch suppliers can be specified as important factors that reduce PepsiCo supplier bargaining power. Rivalry among existing firms is highly intensive. Beverage, food and snack manufacturing industry is highly competitive. The major brands competing with PepsiCo include but are not limited to The Coca Cole Company, DPSG, Kellogg Company, The Kraft Heinz Company, Mondelez International Inc., Monster Beverage Corporation, Nestlé S.A., Red Bull GmbH and Snyder’s-Lance, Inc. The Coca Cola Company is PepsiCo’s primary competitor and the US market share of these two brands amount to 20 per cent and 24 per cent respectively.[3] On the global scale, on the other hand, Coca-Cola has a leadership position with a market share of about 48.6 per cent compared to PepsiCo’s market share of 20.5 per cent (see Figure 2 below). Figure 2. Market share of carbonated beverages worldwide as of 2015[4] Threat of substitute products for PepsiCo is significant. The range substitutes for PepsiCo’s beverage products include tea, coffee, tap water and a…

Porter’s Five Forces is a strategic analytical model developed by Michael Porter (1979)[1] and it is used to assess the overall competitive climate in an industry. Porter’s five forces are represented in Figure 1 below: Figure 1 BMW Porter’s Five Forces Threat of substitute products or services is insignificant. It is important to clarify that there are different substitute products and services for luxury cars than cars in general. Specifically, substitute products and services for cars in general as means of transportation include bicycles, motorcycles, underground (subway), buses and other forms of public transportation. The threat of substitute for cars in general as a means of transportation can be assessed as high. Luxury car segment, on the other hand, is different in a way that they are purchased to satisfy needs beyond transportation. People purchase BMWs, Rolls-Royces, Porches and Mercedes Benzes as a means of self-expression to satisfy their need for self-perception of achievement, success and status. From this point of view, it can be argued that the threat of substitute products and services for luxury cars is insignificant, because owning a luxury car is a ‘must-have’ for wealthy people and the need for a luxury car often comes before the need for luxury watches, yachts, villas and other attributes of a rich lifestyle Rivalry among existing firms is intensive. There is a fierce competition in the global market of the premium car segment and the extent of differentiation between vehicles of each individual brand is significant. The level of advertising expenditure and the efficiency of the marketing communication strategy play critical role in the luxury car segment since businesses operating in this segment attempt to charge extra money for the perception of status, achievement, recognition and success associated with owning their vehicles. As it is illustrated in Figure 2 below, in…

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. Walmart Porter’s Five Forces are represented in Figure 1 below: Figure 1. Walmart Porter’s Five Forces Rivalry among existing firms is intense. Walmart is engaged in cut throat competition with many other grocery retail chains and supermarkets such as Costco Wholesale Corporation, Dollar General Corporation, Dollar Tree, Inc., Kohl’s Corporation, Macy’s Inc, Sears Holdings Corporation, Target Corporation and others. At the same time, as it is illustrated in Figure 2 below, the pattern of changes of grocery industry concentration for more than two decades has been in favor of major market players such as Walmart, Kroger, Costco and Safeway. Market share of these large companies have been consistently increasing compared to grocery stores of smaller sizes partially due to the cost advantage gained via economies of scale. Figure 2. Changes in industry concentration in the US grocery market[2] Threat of substitute products or services. Walmart sells thousands of products belonging to the following categories: groceries entertainment health and wellness – including pharmacy hardlines – including stationery, auto spares, and accessories hardware apparel home furnishings household appliances It can be argued that the threat of substitute products is irrelevant for Walmart due to the abundant range of products sold by the retailer. In other words, Walmart sells a wide range of products, as well as, substitutes to this products, therefore, the impact of this particular threat to Walmart can be stated to be irrelevant. Bargaining power of Walmart suppliers is insubstantial. Due to the size and the scope of its business, Walmart secures the lowest prices from its suppliers to sustain its cost leadership competitive advantage. Walmart paid its suppliers USD 13.5 billion in total in 2015 alone.[3] Along with…

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. These forces are represented in Figure 1 below. You can learn the theory of Porter’s five forces analysis here. Figure 1 Porter’s Five Forces Threat of new entrants into automobile manufacturing industry is low. This is because of a set of industry entry barriers such as huge amount of capital requirements and access to distribution channels. Extensive economies of scale enjoyed by current automobile brands is another factor that creates a substantial barriers for new entrants. In case of Toyota in particular, due to its size and the global scope of its operations, the company immensely benefits from the economies of scale and this benefit is passed to consumers to reduce the prices of vehicles and stay competitive. Moreover, an immense role of product differentiation, expected retaliation from existing auto manufacturers and certain regulatory barriers in most markets are additional range of factors that reduce the threat of new entrances to the market. Bargaining power of suppliers in vehicle manufacturing industry is insignificant. This is because there is a great numbers of suppliers of various parts and the importance of volume for most suppliers is paramount. Supplier switching cost for an auto manufacturer varies depending on the type of supplier and the nature of the product delivered by the supplier. In case of Toyota, due to its reliance on lean manufacturing and just-in-time supply chain management, suppliers that are located closely to manufacturing units have greater bargaining power. Rivalry among existing firms is aggressive. In the global marketplace Toyota competes with General Motors, Volkswagen, Daimler, BMW Group, Honda Motor, Ford Motor Company, Nissan, Hyundai Motor, SAIC Motor and others. As it is illustrated in Figure…