Toyota Porter’s Five Forces Analysis

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. These forces are represented in Figure 1 below. You can learn the theory of Porter’s five forces analysis here.

Threat of new entrants into automobile manufacturing industry is low. This is because of a set of industry entry barriers such as huge amount of capital requirements and access to distribution channels. Extensive economies of scale enjoyed by current automobile brands is another factor that creates a substantial barriers for new entrants. In case of Toyota in particular, due to its size and the global scope of its operations, the company immensely benefits from the economies of scale and this benefit is passed to consumers to reduce the prices of vehicles and stay competitive. Moreover, an immense role of product differentiation, expected retaliation from existing auto manufacturers and certain regulatory barriers in most markets are additional range of factors that reduce the threat of new entrances to the market.

Bargaining power of suppliers in vehicle manufacturing industry is insignificant. This is because there is a great numbers of suppliers of various parts and the importance of volume for most suppliers is paramount. Supplier switching cost for an auto manufacturer varies depending on the type of supplier and the nature of the product delivered by the supplier. In case of Toyota, due to its reliance on lean manufacturing and just-in-time supply chain management, suppliers that are located closely to manufacturing units have greater bargaining power.

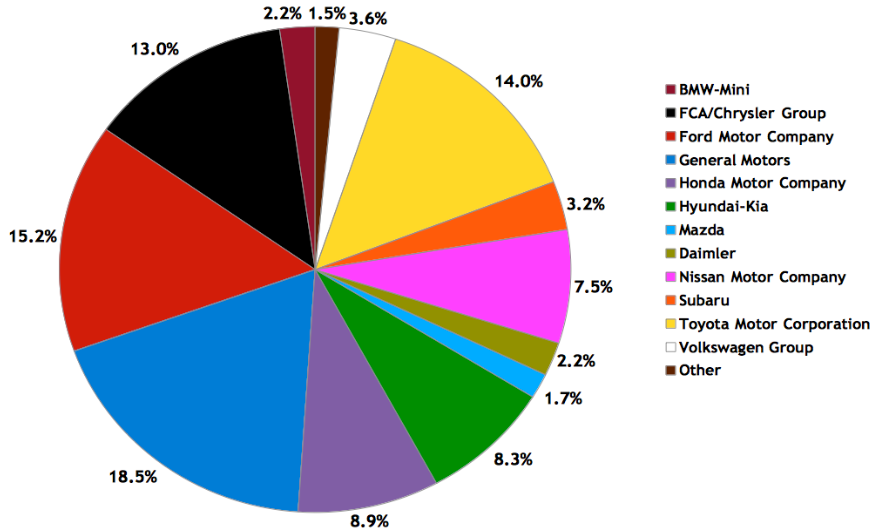

Rivalry among existing firms is aggressive. In the global marketplace Toyota competes with General Motors, Volkswagen, Daimler, BMW Group, Honda Motor, Ford Motor Company, Nissan, Hyundai Motor, SAIC Motor and others. As it is illustrated in Figure 2 below, although Toyota maintains a leadership position in the global marketplace in terms of sales, GE has a greater market share in the US market, partially as a result of protectionism policies of the US government….

Figure 2 Automobile industry market share in the US

Toyota Motor Corporation Report contains more detailed discussion of Toyota Porter’s Five Forces analysis. The report illustrates the application of SWOT, PESTEL and Value Chain analytical frameworks and discusses Toyota’s marketing strategy and company’s approach towards Corporate Social Responsibility (CSR).

[1] Porter, M. (1979) “How Competitive Forces Shape Strategy” Harvard Business Review