Posts Tagged ‘IT’

Samsung organizational culture has been traditionally seniority-oriented reflecting the national culture of its home country South Korea. Positive aspects of such a culture may include higher levels of employee loyalty and faster speed of decision making. On the negative side, however, seniority-oriented organizational culture does not encourage junior employees to communicate their ideas and propose initiative to their superiors. Such ideas and initiatives may prove to be insightful and play an instrumental role in new product development or adding innovative features and capabilities to existing products. Taking into account critical role of innovations and creativity in electronics industry, it can be argued that negative aspects of seniority-oriented corporate culture outweigh its positive aspects for Samsung. The company is aware of this and in 2016, the senior management announced plans to reform Samsung organizational culture. These reforms included simplification of job rankings from the previous seven stages to four stages and employees calling each other by their name with the suffix “-nim,” which shows respect in Korean, instead of calling them by their job titles, such as manager or director.[1] Moreover, culture-related changes vowed by the company included holding more online internal discussions and reducing extraneous meetings, reducing overtime and encouraging employees to spend their weekends with family or pursuing professional education opportunities.[2] However, the implementation of cultural changes announced above a year ago, now seems questionable. This is because Jay Y. Lee, former Samsung executive and de facto head of the Samsung conglomerate who announced these cultural changes was jailed for five years for offering bribes to former president of South Korea and other officials, as well as, for other crimes.[3] Samsung Group Report contains a full analysis of Samsung organizational culture. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s…

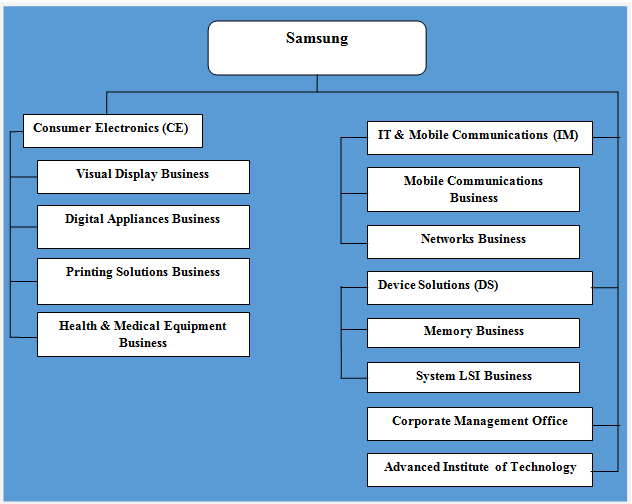

Samsung organizational structure is divisional and the company is divided into three key divisions: IT & Mobile Communications (IM), Consumer Electronics (CE), and Device Solutions (DS). The rationale behind the choice of divisional organizational structure relates to Samsung’s large product portfolio and differences between products and services the company offers to the market. Accordingly, Samsung’s each division is managed separately taking into account the characteristics of their products that have implications on new product development, marketing, selling and other aspects of the business. Moreover, Samsung Electronics has more than 200 subsidiaries around the world. Figure below illustrates Samsung organizational structure: Samsung organizational structure As it is illustrated in figure above, apart from three divisions, Samsung organizational structure also integrates corporate management office and Samsung Advanced Institute of Technology (SAIT). Corporate management office deals with overall management of the group and also has administrative responsibilities. SAIT is Samsung Group’s R&D hub, established as the incubator for the development of new products and services. The senior management completed its review of optimal organizational structure on April 2017 and decided not to convert to a holding company structure.[1] Following a series of recent scandals involving Samsung management that culminated in Jay Y. Lee, the former de facto head of the Samsung conglomerate being jailed for 5 years[2], it can be argued that Samsung organizational structure will change in the foreseeable future. Specifically, Samsung organizational structure may change to make governance and decision making practices more transparent to eliminate or at least to reduce the cases of future scandals. Samsung Group Report contains a full analysis of Samsung organizational structure. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on Samsung. Moreover, the report contains analyses…

Samsung leadership at the most senior level has been found to be involved in a number of scandals and contradictions during the past years. There is a consensus among business theorists and practitioners that the main reasons of these scandals relate to owner-management model of the global electronics company. “Since taking over in 1987, Samsung Electronics chairman Lee Kun-hee, part of the second generation of managers from the ruling Lee family, made great contributions to the group’s astonishing management performance and the development of Samsung into South Korea’s leading global IT business”.[1] At the same time, Lee Kun-hee was convicted twice in 1995 and 2008 for slush fund cases, but escaped punishment over the X-files scandal. There were other incidents involving Samsung senior leadership belonging to the ruling family as well. These have escalated into the emergence of massive leadership crisis in 2017. Specifically, Jay Y. Lee, the former de facto head of the Samsung conglomerate, was given 5-year jail term for his role in bribery and embezzlement, part of a series of scandals that led in March to the ouster of Park Geun-hye, South Korea’s first female president.[2] Currently, the company is led by Dr. Oh-Hyun Kwon is Chief Executive Officer and Vice Chairman, Samsung Electronics; Head of Device Solutions. Samsung Board of Directors consists of four executive directors and five independent directors. The independent directors also meet separately from the Board of Director’s executive directors in order to promote a free exchange of ideas on all aspects of the company’s management.[3] As it is illustrated in figure below, Samsung has a leadership development program that comprises all five leadership levels throughout the company. Samsung Leadership Development Program Samsung Group Report contains a full analysis of Samsung leadership. The report illustrates the application of the major analytical strategic frameworks in…

Samsung business strategy is marked with a high level of flexibility in a way that the company is determined in changing its strategy dramatically according to changes in external business environment. Few people know that the Samsung initially started as a grocery store in Korea in 1938, switched to noodle business in 1940 and moved to sugar production in 1950. Later, Samsung became engaged in woollen mill in 1954 and insurance and securities business in 1956. Samsung produced black and white TV as the first technological product in 1960 and since then the company emerged as one of the leaders in technology and electronics market segments in the global scale. Frequent change of direction and new product development persists as important features of Samsung business strategy to this day. Samsung business strategy consists of the following three pillars/elements/parts: 1. Effective market readership. A market reader can be defined as a company that closely observes the market and is fast in replicating new products and/or introducing new features in existing products, initially introduced by other companies. Specifically, Samsung has proved effective in replicating the design and important features of smartphones from its main competitor, Apple. It has been noted that “one internal Samsung presentation from 2010 provided a step-by-step process for Samsung engineers to follow in an effort to steal so much of what made the iPhone such a unique product”.[1] 2. Scanning and utilising opportunities in the market. Samsung business strategy integrates constant search for gaps in the market and exploits the opportunity with positive implications on the bottom line for the business. For example, Samsung noticed that Asian-language speakers in particular wanted a device that they could hand-write on, because drawing characters is easier with a pen. The result was a development of series of Samsung Note devices as…

Samsung Corporate Social Responsibility (CSR) programs and initiatives are facilitated through the Sustainability Management Council, which consists of 14 related departments that handle issues from 10 different areas, including society and the environment.[1] Samsung Global Code of Conduct is based on the following principles: Compliance with laws and ethical standards Maintenance of clean organizational structure Respecting customers, shareholders and employees Caring for the environment, health and safety Being socially responsible corporate citizen CSR aspect of the business is managed by Samsung CSR Committee. The company releases Supplier Responsibility Progress Report annually and it includes the details of CSR programs and initiatives engaged by the company. Samsung Electronics addresses CSR aspects of the business in four directions: social contributions, green management, health and safety and sharing growth. Samsung Supporting Local Communities Samsung Tech Institute encourages independence and self-reliance among young adults via systematic vocational education. The initiative had 39,659 beneficiaries by the end of 2015. Samsung SMART School addresses an important gap in the global education by improving educational environment for students residing in disadvantaged areas. In 2015 alone 224,753 students attended Samsung SMART School. Samsung Solve for Tomorrow is a program that aims to tackle important social issues. The program engages students and non-profit organizations to identify the most pressing social problems and to find and to implement solutions to these problems Samsung Care Drive facilitates a range of healthcare programs in order to deal with the help of technology. As of 2014, the company had 30 active programs primarily in China, Russia, and several countries in Africa. Samsung Nanum Village aims to target the roots of poverty via providing an effective infrastructure to socially disadvantaged segments of the population. Within the scope of this program, partnerships are formed with national and local governments to provide an extensive…

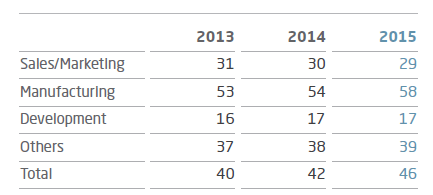

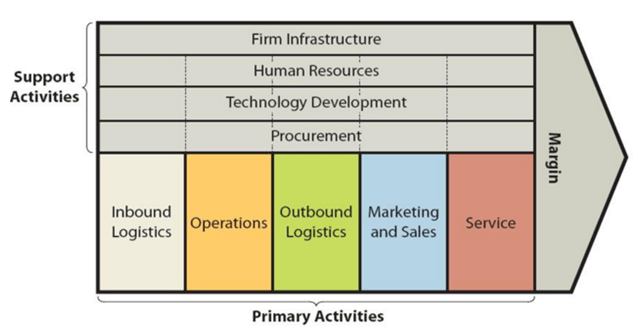

Samsung value-chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage for the global electronics company. Figure 1 below illustrates the essence of value chain analysis. Figure 1 Samsung Value chain analysis Samsung Primary Activities Samsung Inbound logistics Samsung has 579 suppliers globally and the company’s supply chain includes over 2,700 suppliers in various industries across the world.[1] The majority of Samsung suppliers are based in Asia and accordingly, 79.4% of its supply-chain expenses occur in Asia. This is followed by Americas (14.8%), Europe (4.4%) and other places.[2] In order control inbound logistics aspect of the business more effectively, Samsung owns a number of logistics firms as its subsidiaries. The most notably, Samsung Electronics Logitec, established in 1998, is an integrated enterprise logistics management agent that serves logistics needs of the company with 540 employees and 8,600 partner employees around the globe.[3] Figure 2 Samsung supply chain management principles[4] Strategic relationships with suppliers is one of the main sources of value creation for the multinational electronics company. For example, the company changed the payment cycle from twice a month to four times a month in 2011 and implemented early payments around Korea’s traditional holiday seasons, thereby helping to smooth the funding of operations for suppliers.[5] Samsung Operations Samsung Electronics is a global company that operates 38 production bases in 17 countries around the world.[6] The company manufactures 90% of its products in-house. Samsung operations are divided into three key divisions: IT & Mobile Communications (IM) Consumer Electronics (CE) Device Solutions (DS) At the end of 2015, Samsung Electronics maintained 199 worldwide operation hubs, including manufacturing subsidiaries, sales subsidiaries, design centres, research centres, and 15 regional head offices worldwide. Figure 3 below illustrates the full scope of Samsung global network of operations.…

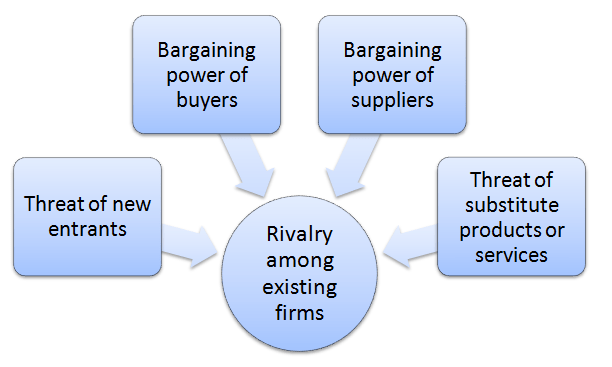

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. Samsung Porter’s Five Forces are represented in Figure 1 below: Figure 1 Samsung Porter’s Five Forces Threat of substitute products or services for each product category offered by Samsung is substantial. Samsung smartphones can be substituted with ordinary mobile phones at any time with no additional costs for customers. Moreover, there is an increasing range of mobile and desktop applications that represent relevant substitute for Samsung’s mobile communications business. Samsung visual display business is threatened by indirect substitution such as increasing popularity of leading active lifestyle and spending time outdoor. In other words, representatives of Samsung target customer segment may prefer to spend time outdoors, rather than in front of TV with negative implications on the volume of sales of Samsung TV’s. Furthermore, increasing popularity of cloud storage is emerging as viable alternative for printing and this tendency may decrease the sales of Samsung printing solutions products in the foreseeable future. Rivalry among existing firms is intense. Approaching market saturation for many product categories in consumer electronics industry intensifies the rivalry among existing firms and there is a little differentiation among the range of products offered. Moreover, the great number and diversity of competitors operating in the market fuels the extent of competition in the industry. In smartphone market segment, one of its critical product categories, Samsung competes with a wide range of suppliers such as Apple, LG, Lenovo, ZTE, Huawei, OPPO and others. Nevertheless, as it is illustrated in Figure 2 below, Samsung has been able to maintain leadership position in the global scale for the last six years. Figure 2 Global market share by leading smartphone manufacturers[2] Bargaining power of suppliers…

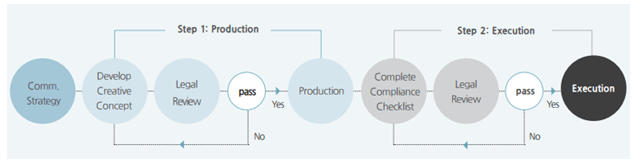

Samsung’s has the largest marketing budget in the competition and this fact partially explains the leadership position of the business in terms of market share. Samsung spent a total of USD10.2 billion (11.5 trillion won) on marketing in 2016 alone. This included USD3.9 billion (4.4 trillion won) toward advertisements, a 15% increase from 2015[1]. Samsung marketing strategy integrates various forms of advertising, events and experiences, public relations, direct marketing and personal selling as discussed further below in more details. The multinational electronics company has 53 global sales bases worldwide. Samsung marketing strategy is based on the following principles: Samsung 7ps of marketing places greater emphasis on product element of the marketing mix, compared to other elements such as process, people and physical evidence. Specifically, with 34 R&D centres worldwide and 53 global production bases, the multinational electronics company attempts to ensure the continuous pipeline of new products with innovative features and capabilities. Samsung segmentation targeting and positioning strategy integrates multi-segment, imitative and anticipatory positioning techniques. Samsung marketing communications strategy, as it is illustrated in figure below, comprises two steps and each step involves a set of separate activities. It has to be noted that legal review as an important element of marketing communication process is present in both steps – production and execution. This is because neglecting legal implications associated with the development and delivery of marketing communication messages can cause considerable damage to the brand image with severe financial implications. Samsung Electronics marketing communication process[2 Samsung Group Report contains a full analysis of Samsung marketing strategy. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on Samsung. Moreover, the report contains analyses of Samsung leadership, organizational structure and…

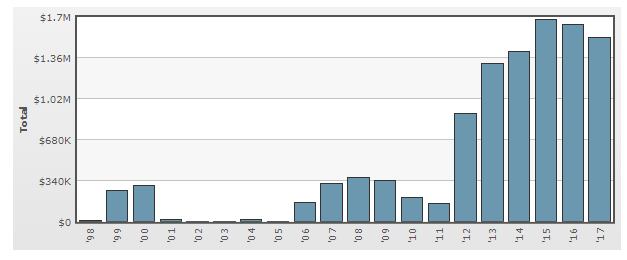

PESTEL is a strategic analytical tool used to assess the impact of external factors on businesses. Samsung PESTEL analysis involves critical analysis of political, economic, social, technological, environmental and legal factors affecting the multinational electronics company. Political Factors in Samsung PESTEL Analysis A set of political factors such as political stability in the country, government attitude towards the industry and the company, home market lobbying and pressure groups, international pressure groups, risk of military invasion of the country and others affect revenue and long-term growth prospects of Samsung Electronics in direct and indirect ways. Samsung Electronics is found to be involved in a number of political scandals in its home market in South Korea. Lee Kwang-jae, Uri Party representative working for South Korean President Roh Moo-hyun officially admitted the receipt of 50 to 60 billion KRW from Samsung Group in the forms of bonds to be used in the presidential campaign in 2002. Moreover, the prosecution found that the company has also funded the opposition, Grand National Party via 2.47 billion KRW before the election.[1] The instance mentioned above represents an attempt by the company to achieve positive impact of political factors via illegal means and methods with potentially severe detrimental impact on Samsung brand image. In August 2017, Jay Y. Lee, the former de facto head of the Samsung conglomerate, was given 5-year jail term for his role in bribery and embezzlement, part of a series of scandals that led to the ouster of Park Geun-hye, South Korea’s first female president.[2] As it is illustrated in figure below, Samsung has increased the amount of its political lobbying significantly starting from 2012. It can be argued that these spending included controversial payments as discussed above. Annual lobbying by Samsung Group[3] Economic Factors in Samsung PESTEL Analysis Strong Korean currency is one of…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Samsung SWOT analysis: Strengths 1. Leadership in visual display market segment 2. Strong patent portfolio 3. High brand value 4. Global leadership across all mobile and smartphone markets 5. Solid financial position of the company Weaknesses 1. Absence of own OS and software 2. Damage to brand image due to product safety issues 3. Low profit margin 4. Extensive product portfolio 5. Competitive advantage hard to sustain Opportunities 1. Further increasing investment in R&D 2. Focusing on mobile advertisements 3. Entering cloud business segment 4. Increasing presence in emerging markets 5. Entering into strategic collaboration with affiliated businesses Threats 1. Changes in currency exchange rate 2. Intensification of competition due to the slowing growth in the industry 3. Disruption in the pipeline of new products 4. Patent infringement lawsuits 5. Disruptive innovation by competitors Samsung SWOT analysis Strengths 1. Samsung has maintained the largest market share in the global market of visual display since 2006. Samsung Display Solutions has advanced the field of digital signage by introducing leading-edge new hardware, including new video walls featuring the world’s narrowest bezel and the world’s first TIZEN-powered premium signage.[1] Samsung had a global TV market share of 27.6% in 2015. The global market share for UHD TV market share amounted to 34.1% for the same year.[2] Moreover, in 2015 Samsung Electronics had mobile phone market share of 21.1%, smartphone market share of 22.2% and tablet market share of 15.0%.[3] 2. Strong patent portfolio is one of the solid bases of Samsung competitive advantage. In 2015 alone, the multinational electronics company registered 5072 global patents in the US Patent and Trade Office. Samsung is the 2nd largest patent holder in the US since 2006.[4] The multinational…