Search results for: Mckinsey 7s

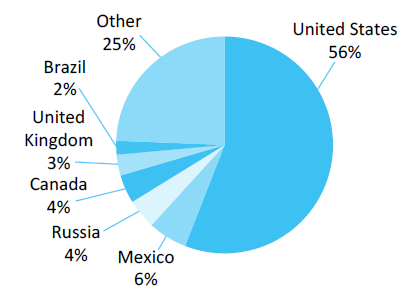

PepsiCo Inc. is a US-based global food, snack and beverage company that was incorporated in Delaware in 1919 and reincorporated in North Carolina in 1986. Today, PepsiCo brand portfolio includes a range of globally famous brand names such as Pepsi, Lays, Lipton, Doritos, Tropicana, Walkers, Miranda, Cheetos and others. In total, PepsiCo portfolio comprises 22 brands and each of these brands have generated at least one billion USD in retail sales in 2015. Products belonging to PepsiCo portfolio are consumed about one billion times each day in more than 200 countries and territories. PepsiCo’s mission statement is formulated as “to provide consumers around the world with delicious, affordable, convenient and complementary foods and beverages from wholesome breakfasts to healthy and fun daytime snacks and beverages to evening treats” The company employs 263,000 people globally, including approximately 110,000 people within the United States.In 2015, PepsiCo achieved 5 per cent organic revenue growth with a cash flow of more than USD 8.1 billion. About 53 per cent of net revenues were generated from food business, whereas net revenues generated from the beverage businesses amounted to 47 per cent. PepsiCo has major impact in the US economy. The company has been acknowledged as the Number One contributor to retail sales growth in the U.S. in 2015, generating more growth than the next 15 largest food and beverage manufacturers combined. PepsiCo Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on PepsiCo. Moreover, the report contains analyses of PepsiCo’s business strategy, leadership and organizational structure and its marketing strategy. The report also discusses the issues of corporate social responsibility. 1. Introduction 2. Business Strategy 3. Leadership and Organizational Structure 4. SWOT Analysis 4.1 Strengths 4.2 Weaknesses…

PepsiCo leadership of six divisions have nearly 140 years of combined PepsiCo experience across multiple categories, markets and functions[1]. PepsiCo Board of Directors comprises 15 members with Indra K. Nooyi serving as Chairman of the Board and Chief Executive Officer. The name of Indra Nooyi is on every list of top female leaders around the globe and she is widely acknowledged as a charismatic and effective corporate leader. PepsiCo leadership can be assessed as strong and dynamic and this has been reflected on strong financial performance of the company over the years. Despite an evident effectiveness of PepsiCo leadership, a lack of clarity on CEO succession plan can be specified as a noteworthy issue. Specifically, a number of reputable members of senior management team and rising starts have been leaving PepsiCo recently. These include the departure of Enderson Guimaraes executive vice president for Global Categories and Operations, the Pepsi President John Compton, former nutrition head Debra Crew and former president Zein Abdalla. It has been noted that “when questioned about the string of high-level departures, PepsiCo has consistently pointed to its status as a well-known supplier of executives to other companies, a talent factory of sorts”.[2] Nevertheless, this tendency may cause CEO-succession-related problems in long-term perspectives. PepsiCo organizational structure can be described as divisional and it integrates the following divisions: Frito-Lay North America (FLNA). Quaker Foods North America (QFNA). Latin America Asia, Middle East & North America (AMENA). Europe & Sub-Saharian Africa (ESSA). North America Beverages (NAB). Each division is led by a divisional CEO, who report to PepsiCo CEO and Chairman Indra K. Nooyi. Besides divisional CEOs, PepsiCo leadership team comprises the following positions: Executive Vice President, Communications President, North America Nutrition Senior Vice President, Chief HR officer for Human Capital Management Services and Operations Senior Vice President and…

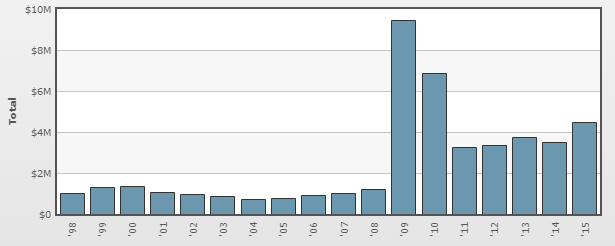

Changes in external environment might affect organizational performance in direct and indirect manners; therefore they need to be taken into account in strategic planning. PepsiCo PESTEL analysis can be highlighted as the most appropriate strategic analytical tool for specifying and categorizing external factors impacting businesses. Political Factors Government stability in the USA and other countries selling PepsiCo products is a major political factor for the company. PepsiCo is also impacted by bureaucracy, trade unions, corruption, home market lobbying, the freedom of press and a range of other political factors either directly or indirectly. PepsiCo actively attempts to influence political factors to benefit its business via its lobbying initiatives. As it is illustrated in figure below, the amount of money PepsiCo spends annually for lobbying has increased more than six-fold during the last ten years to reach USD 4.47 million in 2015. PepsiCo uses a set of lobbying firms such as Russell Group, FTI Government Affairs, Duberstein Group and Covington and Burling[1] to secure its interests via political channels. PepsiCo’s annual lobbying budget[2] Economic Factors Economic factors impacting PepsiCo include rise of inflation and unemployment in the USA. Rising prices of raw materials have to be mentioned as another significant economic factor. Additionally, changes in income levels of current and perspective PepsiCo consumers can be highlighted as a substantial economic factor that impacts the business. Strong USD against other major world currencies is one of the most significant economic factors directly impacting the amount of profit reported by PepsiCo. For example, in quarter 1, 2016, PepsiCo’s total sales declined by 3 per cent to USD 11.86 billion, the sixth straight quarter of decline partially caused by a strong dollar.[3]… PepsiCo Inc. Report contains the full discussion of PepsiCo PESTEL analysis. The report also illustrates the application of the major analytical strategic frameworks…

SWOT analysis is one of the most popular strategic analytical tools that used for strategic decision making. The acronym stands for strengths, weaknesses, opportunities, and threats associated with a particular business. PepsiCo SWOT analysis is presented on table below: Strengths 1. Large, yet focused brand portfolio in food, snack and beverage industry. 2. Strong leadership from CEO Indra Nooyi 3. High level of customer loyalty for most of the brands within product portfolio 4. Extensive experiences in mergers and acquisitions 5. Integrated supply-chain and distribution practices across PepsiCo brands Weaknesses 1. Overdependence on domestic market in the USA 2. High level of dependence on large supermarkets such as Wal-Mart 3. “Aquafina” tap water scandal and product recall cases 4. PepsiCo brand perceived as ‘unhealthy’ 5. No presence outside of food, snack and beverage industry Opportunities 1. Improving health implications of products 2. Business diversification into other industries 3. Increasing presence in emerging economies 4. Increasing the effectiveness of CSR strategy 5. Focusing on research and development Threats 1. Intensification of competition 2. Rapid decline in the sales of carbonated drinks 3. New product recalls due to quality scandals 4. High amounts of sugar or salt in products being criticized by government and non-government health organizations PepsiCo SWOT analysis Strengths 1. PepsiCo portfolio is large and it comprises 22 brands in food, snack and beverage industry.[1] Despite the large number of companies it contains, PepsiCo product portfolio can be described as highly focused because of the uniformity of product positioning across the whole portfolio. According to marketing messages, the consumption of all products within PepsiCo portfolio is associated with being active and dynamic and enjoying life to the full extent. Such a uniformity in product positioning provides significant advantages to PepsiCo in terms of promoting its products in an efficient manner despite…

PepsiCo mission statement has been worded by CEO Indra Nooyi as ‘Performance with Purpose’ and this principle is closely integrated with the strategic direction chosen for the company. The most prominent aspects of PepsiCo business strategy are based on the following six principles: First, achieving growth through mergers and acquisitions (M&A). M&A can offer the advantages of gaining access to competencies and infrastructure, reducing direct costs and overheads and achieving organic growth. Recently, PepsiCo has completed as a set of important acquisitions such as acquisition of juice and diary businesses Lebedyansky and Wimm-Bill-Dann in Russia, Lucky snacks and Mabel cookies in Brazil, and Dilexis cookies in Argentina. M&A can be specified as one of the cornerstones of PepsiCo business strategy. As a result of an aggressive pursuit of this strategy, today PepsiCo portfolio comprises 22 brands and each of these brands have generated at least one billion USD in retail sales in 2015.[1] Second, forming strategic alliances in the global scale. Specifically, strategic partnerships have been formed with Tingyi in China in order to claim a share in growing beverage market in China. Moreover, formation of a joint-venture with Tata in India to enhance drinking water manufacturing capabilities, and initiation of strategic partnership with Almarai in Saudi Arabia can be mentioned to illustrate PepsiCo’s adoption of strategic alliances as an integral part of the corporate strategy. Important strategic alliances are formed by PepsiCo at home markets as well. Specifically, by forming a strategic alliance with Starbucks – a global coffee house chain, PepsiCo has been able to claim its share from increasing energy drink market segment. Third, focusing on emerging markets. An aggressive pursuit of this strategy has had positive impact on the bottom line. The year of 2015 witnessed a double-digit growth in the sales of snacks in China and…

PepsiCo Inc. is a US-based global food, snack and beverage company that was incorporated in Delaware in 1919 and reincorporated in North Carolina in 1986. Today, PepsiCo brand portfolio includes a range of globally famous brand names such as Pepsi, Lays, Lipton, Doritos, Tropicana, Walkers, Miranda, Cheetos and others. In total, PepsiCo portfolio comprises 22 brands and each of these brands have generated at least one billion USD in retail sales in 2015. Products belonging to PepsiCo portfolio are consumed about one billion times each day in more than 200 countries and territories (Annual Report, 2015). PepsiCo’s mission statement is formulated as “to provide consumers around the world with delicious, affordable, convenient and complementary foods and beverages from wholesome breakfasts to healthy and fun daytime snacks and beverages to evening treats” The company employs 263,000 people globally, including approximately 110,000 people within the United States. In 2015, PepsiCo achieved 5 per cent organic revenue growth with a cash flow of more than USD 8.1 billion. About 53 per cent of net revenues were generated from food business, whereas net revenues generated from the beverage businesses amounted to 47 per cent (Annual Report, 2015). PepsiCo has major impact in the US economy. The company has been acknowledged as the Number One contributor to retail sales growth in the U.S. in 2015, generating more growth than the next 15 largest food and beverage manufacturers combined. PepsiCo Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on PepsiCo. Moreover, the report contains analyses of PepsiCo’s business strategy, leadership and organizational structure and its marketing strategy. The report also discusses the issues of corporate social responsibility. 1. Introduction 2. Business Strategy 3. Leadership and Organizational Structure…

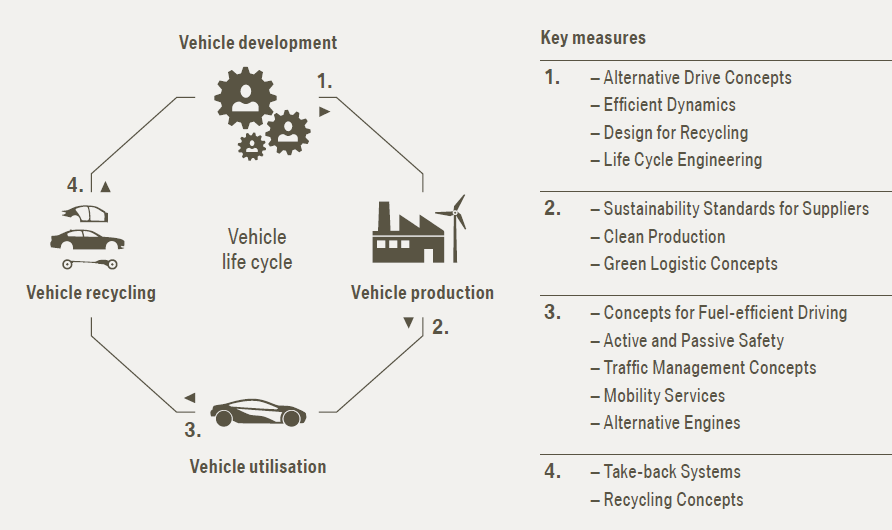

BMW CSR strategy aims to achieve the highest level of sustainability during the each stage of the vehicle life cycle via implementing the relevant set of measures and initiatives. The figure below illustrates the key measures at each stage of the vehicle life cycle process: BMW sustainability throughout the product life cycle[1] BMW Group has won a number of awards for its sustainability efforts. These include the following: Re-gaining the first place in automobile industry in Dow Jones Sustainability Indexes (DJSI) in 2015 Achieving 100 out of maximum 100 points for transparent reporting according to CDP. Being listed on FTSE4Good an index of the British index family on sustainability and corporate governance provided by FTSE in London. BMW CSR Programs and Initiatives The company releases Sustainable Value Report annually and it includes the details of CSR programs and initiatives engaged by the company. Table 3 below illustrates highlights from the latest report for 2015: Categories of CSR activities BMW Group Performance Supporting local communities Care 4 Water initiative carried out in collaboration with the non-profit organisation “Waves For Water” involves employee fundraising activities in more than 50 countries to enable communities to secure their own access to clean water Educating and empowering workers Employees for certain positions are offered flexible working hours such as sabbaticals or “Vollzeit Select” (Fulltime Select) scheme In 2015 BMW Group invested EUR 352 million for employee education and training and development purposes. On average BMW Group employees participated in 4.1 days of training programs in 2015. Labor and human rights Starting from 2016, the company has announced the gradual integration of human rights requirements into global Compliance Management System Employee health and safety Health Management 2020 program has been launched to assist employees to improve and maintain their health. Since its launch in 2014 10,100 employees…

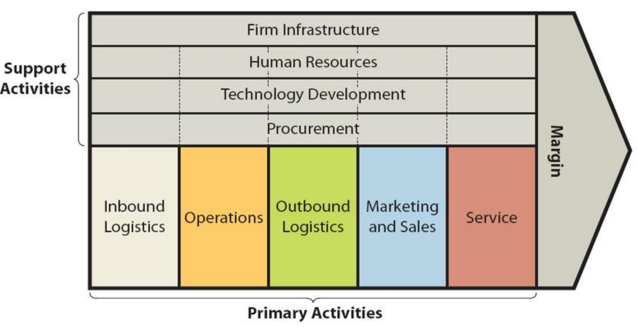

Value chain analysis is an analytical framework that can be used to identify business activities that can create value and competitive advantage to the business. Figure 1 below illustrates the essence of value chain analysis. Figure 1 BMW Value chain analysis Primary Activities Inbound logistics BMW Group has around 13,000 suppliers located internationally[1]. BMW adds value in its inbound logistics primary activity via minimizing transportation costs and sourcing the raw materials of the highest quality. As it is illustrated in Figure 2 below, the company purchases most of its raw materials from Germany (42.6%) and Eastern Europe (19.7%). This is because the majority of manufacturing and assembly units are based in Germany and Europe and the company purchases from trusted suppliers in close proximity in order to reduce the costs of logistics and ensure an undisputed supply. Figure 2 Regional mix of BMW purchase volumes[2] Operations BMW Group is divided into the following four business segments: Automotive. In 2015, this segment generated the gross profit margin of 17.7 per cent. Motorcycles. Gross profit margin in motorcycles segment in 2015 amounted to 22.5 per cent. Financial Services. This segment deals with providing credit financing and leasing for BMW Group brand cars and motorcycles to retail customers. Gross profit margin in financial services segment equalled to 13.3 per cent in 2015. Other Entities. In 2015, this segment generated EUR 211 million profit before tax, which is EUR 57 million higher than the previous year. BMW runs a complex manufacturing network in 30 sites in 14 countries[3]. The company opened its latest engine plant in Shenyang, China in January 2016. In terms of sales BMW Group is represented in more than 150 countries worldwide. BMW Group adds value to its operations primary activity mainly via the use of robotics technologies to a considerable…

Porter’s Five Forces is a strategic analytical model developed by Michael Porter (1979)[1] and it is used to assess the overall competitive climate in an industry. Porter’s five forces are represented in Figure 1 below: Figure 1 BMW Porter’s Five Forces Threat of substitute products or services is insignificant. It is important to clarify that there are different substitute products and services for luxury cars than cars in general. Specifically, substitute products and services for cars in general as means of transportation include bicycles, motorcycles, underground (subway), buses and other forms of public transportation. The threat of substitute for cars in general as a means of transportation can be assessed as high. Luxury car segment, on the other hand, is different in a way that they are purchased to satisfy needs beyond transportation. People purchase BMWs, Rolls-Royces, Porches and Mercedes Benzes as a means of self-expression to satisfy their need for self-perception of achievement, success and status. From this point of view, it can be argued that the threat of substitute products and services for luxury cars is insignificant, because owning a luxury car is a ‘must-have’ for wealthy people and the need for a luxury car often comes before the need for luxury watches, yachts, villas and other attributes of a rich lifestyle Rivalry among existing firms is intensive. There is a fierce competition in the global market of the premium car segment and the extent of differentiation between vehicles of each individual brand is significant. The level of advertising expenditure and the efficiency of the marketing communication strategy play critical role in the luxury car segment since businesses operating in this segment attempt to charge extra money for the perception of status, achievement, recognition and success associated with owning their vehicles. As it is illustrated in Figure 2 below, in…

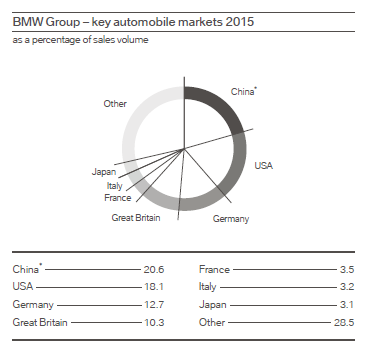

BMW’s 7Ps of marketing consists of product, place, price, promotion, process, people and physical evidence elements of the marketing mix. Product. BMW Group is engaged in development, manufacturing and the sale of engines as well as all vehicles equipped with those engines. BMW Group owns and sells its vehicles under the following three brands: BMW MINI Rolls Royce The company pursues product differentiation business strategy and maintains 13 research and development centres in five countries[1]. Vehicles produced under BMW Group brands belong to the premium segment and accordingly, they have highly efficient and reliable with advanced set of features and capabilities. BMW leads the automobile industry in electromobility and the brand is also famous for achieving a high level of integration of internet and digitalization in its vehicles. Place. BMW Group has about 6,000 dealerships and sales representatives in 150 countries globally.[2] The worldwide distribution network currently consists of around 3,310 BMW, 1,550 MINI and 140 Rolls-Royce dealerships[3] In China alone, around 60 BMW dealerships were opened in 2015[4]. The dealership and agency network for BMWi comprises about 950 locations. As it is illustrated in figure below, China, USA and Germany represent the largest automobile markets for BMW Group and accordingly, these countries accommodate the largest numbers of dealership offices and representatives. BMW Group key automobile markets (Annual Report, 2015) Price. BMW pricing strategy can be described as premium. High level of reliability of BMW Group vehicles and advanced set of features and capabilities integrated into the vehicles come for expensive prices. For example, as of April 2016, BMWi3 electric car costs more than USD 45,000 and customers have to pay more than USD 100,000 for BMW X6 model[5]. Additionally, BMW uses product line pricing strategy charging different prices for different models of its products. Geographical pricing represents another important…