Search results for: Mckinsey 7s

There is a set of macro and micro environmental factors that affect marketing decisions of Tesco marketing management in direct and indirect manners. Macro-environmental factors impacting Tesco marketing decisions are identified through the process of environmental scanning and they include political, economic, social, cultural, technological and legal factors. Micro-environmental factors, on the other hand, relate to the impact of internal and external organisational stakeholders, and the extent of competition in supermarket industry in general. Products and services offered by Tesco and other businesses cannot be attractive to all people in equal terms, because differences in needs and wants among people. Therefore businesses do engage in market segmentation and targeting practices. It can be specified that “market segmentation is based on the generally true concept that the market for a product is not homogenous to its needs and wants”[1]. In simple terms, market segmentation is dividing population members into groups according to their needs, wants and other criteria and developing products and services that aim to satisfy needs and wants of particular groups. Segmentation can be divided into geographic, demographic, psychographic, and behavioural bases. Segmentation, targeting and positioning can be implemented in relation to Tesco brand in general, as well as, its individual products. The Table 2 below specifies target customer segment for Tesco’s own brand TV – Tesco 19-230 18.5 inch Widescreen HD Ready LCD TV DVD Combi with Freeview: Segmentation bases Target customer segment for Tesco Technika 19-230 18.5 inch Widescreen HD Ready LCD TV Geographic Region UK, and 13 other countries Density Rural and urban Demographic Age All age categories Gender Males and females Income Low and middle income category Occupation Students, employees, professionals Education High school, technical, Bachelors, Social status Working class, skilled working class, lower middle class, middle class Family size Single individuals, nuclear…

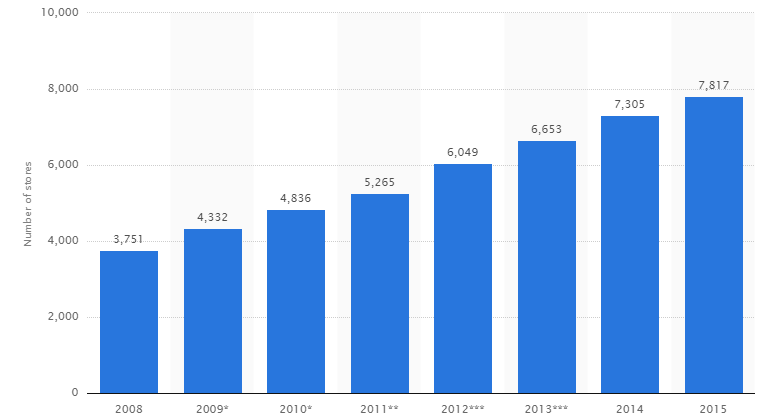

The term marketing mix “is used to describe the tools that the marketer uses to influence demand”[1]. Traditionally, marketing mix contained four elements – product, price, place, and promotion, and additional elements that have added to the concept of marketing mix consist of people, process and physical evidence. Tesco marketing mix is manipulated by the marketing and the senior management to a great extent in order to offer competitive benefits to target customer segment with positive effects on the bottom line. Product. Tesco offers a comprehensive range of products. Specifically, along with food and grocery products the following product categories can be purchased from the supermarket chain: Clothing & jewelry Technology & gaming Health & beauty Home electrical Entertainment & books Home appliances Baby & toddler Garden Toys DIY & Car accessories The range of product categories sold in Tesco stores depend on the type of store with Express stores having the least variety of products and Extra stores offering the widest choice. Moreover, Tesco Bank offers a range of popular banking products such as mortgages, credit cards, personal loans and savings. Place. Place element of the marketing mix relates to locations where customers purchase products and services and the distribution of products to those locations. Tesco utilises two channels to sell its products and services: online and offline. As it is illustrated in figure below, despite the global financial and economic crisis of 2007 – 2009 and other challenges faced by the company, the number of Tesco stores have been consistently increasing for the last eight years to reach 7817 stores in 11 countries by the end of 2015. More than two-thirds of total Tesco sales are made in the UK.[2] Stores are operated in the following format: Metro Express Extra Superstore Changes in the number of Tesco stores worldwide[3] Online sales…

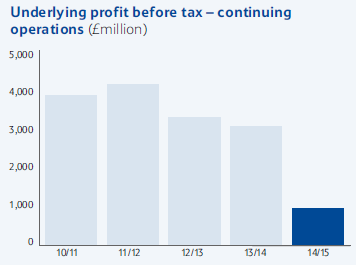

Tesco PLC is a UK-based global supermarket chain and it has 7817 shops and 517,802 employees around the world. Founded in 1919 by Jack Cohen, Tesco has emerged to become the biggest retailer in the UK and more than 80 million shopping trips are made to Tesco stores each week (Annual Report, 2015). Tesco’s mission statement is “to be the champion for customers – to help everyone who shops with us enjoy a better quality of life and an easier way of living”. Tesco business strategy can be described as cost leadership with a focus on availability, range and customer service. During the financial year of 2015, the group sales amounted to GBP 69.7 billion with the group trading profit of GBP 1.4 billion, however, the company made a net loss of GBP 6.4 billion during the same period (Annual Report, 2015). Along with market saturation, such a poor financial performance has been caused by a series of scandals that include an overstatement of commercial income by GBP 208 million (Rigby, 2015) and the cases of supplier mistreatment. It has been revealed that the supermarket chain demanded a payment of GBP 1 million from one of its suppliers, L’Oreal (Ahmed, 2015) and the company has been found to delay payment to suppliers in order to improve its operational profit margins in 2014 (Simpson, 2016). These scandals caused a severe damage to Tesco’s brand image and replacement of the leadership at the top level. The new leadership headed by a new Chairman of the Board John Allan and new CEO Dave Lewis pledged to restore the trust towards the brand via focusing on the core values that had made Tesco popular in the first place. Tesco PLC Report contains the application of the major analytical strategic frameworks in business studies such…

SWOT is an abbreviation that is interpreted as strengths, weaknesses, opportunities and threats related to businesses. The table below illustrates the main points of Tesco SWOT analysis: Strengths 1. Leadership position in the UK 2. Effective online operations 3. Clubcard as an effective consumer information tool 4. Strong property portfolio Weaknesses 1. Weak financial performance 2. Serious damage to the brand image due to commercial income scandal in 2015 3. Reliance on the UK market 4. Diminished employee morale Opportunities 1. Pursuing international market expansion strategy 2. Increasing presence in financial services industry 3. Increasing non-food retail range 4. Enhancing the effectiveness of the marketing strategy Threats 1. Inability of the new leadership to turn over the business 2. Inability to sustain cost leadership competitive advantage 3. Currency fluctuations 4. Emergence of new ethics-related problems Tesco SWOT analysis Strengths 1. Tesco is the biggest retailer in the UK with a grocery market share of 27.9 per cent. Its closest competitor Sainsbury’s has the market share of only 16.6 per cent and the market share of Walmart-owned ASDA is equal to 16.4 per cent.[1] Possessing the largest market share is an important strength regardless of the industry and this position allows Tesco to generate substantial revenues, given it addresses 7Ps of marketing mix in an appropriate manner. 2. The company utilizes online sales channel with a high level of efficiency. Tesco was among the first retailers in the UK to successfully implement online sales channel and currently, revenues generated via online sales account for a solid share of the total revenues. Specifically, in 2015 Tesco online grocery market grew ahead of the market at 20 per cent although the company posted pre-tax loss of GBP 6.37 billion during the same year.[2] The growth of online sales ahead of the market despite…

PepsiCo segmentation, targeting and positioning decisions can be specified as the essence of overall marketing efforts. Segmentation involves dividing population into groups according to certain characteristics, whereas targeting implies choosing specific groups identified as a result of segmentation to sell products. Positioning refers to the selection of the marketing mix the most suitable for the target customer segment. PepsiCo uses multi-segment type of positioning and accordingly, it targets more than one customer segment at the same time with different products or service packages. For example, Pepsi-Cola is positioned as soft drink that tastes good and has a pleasantly refreshing impact. However, Pepsi-Cola contains a high amount of sugar and it is not positioned for customers that are concerned about health implications of consuming carbonated soft drinks. For this specific customer segment PepsiCo offers Diet Pepsi, which is positioned as a soft carbonated drink that contains less among of sugar compared to Pepsi-Cola and other soft drinks. The following table illustrates PepsiCo segmentation, targeting and positioning: Type of segmentation Segmentation criteria PepsiCo target segment Geographic Region Domestic/international Density Urban/rural Demographic Age 15-45 Gender Males & Females Life-cycle stage Bachelor Stage young, single people not living at home Newly Married Couples young, no children Full Nest I youngest child under six Full Nest II youngest child six or over Income Average, above average and high earners Occupation Students, employees, professionals Behavioral Degree of loyalty ‘Hard core loyals’ and ‘Soft core loyals’ Benefits sought Refreshment, enjoying good taste, satisfaction of a habit, spending time Personality Easygoing/determined/ambitious User status Regular users Psychographic Social class Working class, middle class and upper class Lifestyle[1] Aspirer, Succeeder, Explorer PepsiCo segmentation, targeting and positioning It is important to specify that PepsiCo portfolio comprises 22 brands including Pepsi-Cola, Lay’s, Mountain Dew, Gatorade, Tropicana and others[2], and the Table 2 above specifies PepsiCo target…

PepsiCo CSR strategy focuses on three pillars of sustainability: human, environmental and talent. The company releases Global Responsibility Report annually and it includes the details of CSR programs and initiatives engaged by the company. The table below illustrates highlights from the latest report for 2015: Categories of CSR activities PepsiCo Performance Supporting local communities Since 2006, PepsiCo invested USD 850 million to support communities where it operates Through its partnership programs PepsiCo provided access to save water to 6 million people during the period of 2008-2014 Educating and empowering workers Implementation of Lean Six Sigma Training has been increased from 3 to 30 countries during 2010 – 2015. Labor and human rights In 2014, PepsiCo trained 1900 suppliers on Supplier Code of Conduct that focuses on the protection and promotion of human rights The company as Human Rights Operating Committee (HROC) consisting of cross-functional leaders across PepsiCo with the aim of building awareness around promotion of human rights across the company and suppliers Employee health and safety Lost time incident rate in was reduced by 23 per cent in 2014 compared to the previous year Gender equality and minorities In 2015, the company spent USD 1.4 billion with minority-and-women-owned businesses Environment a) energy consumption b) water consumption c) recycling d) CO2 emissions An improvement of 16% energy efficiency was achieved in 2015 Operational water usage per unit of production was reduced by 23 per cent in 2015. The amount of absolute water usage was reduced by 1 billion liters during the same period About 93 per cent of PepsiCo’s waste is diverted from landfill, i.e. 93 per cent of water recycled and re-used More than 130 million pounds of foodgrade recycled polyethylene terephthalate (rPET) was used by PepsiCo in 2014, an increase of about 25% compared to the…

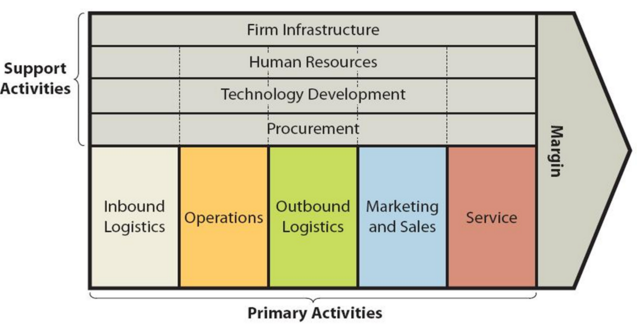

Value chain analysis is an analytical tool used to identify the ways in which businesses create value for customers. The essence of value chain analysis is illustrated in Figure 1 below: Figure 1. PepsiCo Value chain analysis Primary Activities Inbound logistics PepsiCo portfolio comprises 22 brands including Pepsi-Cola, Tropicana, Gatorade, Mountain Dew and Diet Pepsi and each brand belonging to PepsiCo generated at least one billion USD in retail sales in 2015.[1] Inbound logistics practices of each brand within PepsiCo portfolio reflect the nature and quantity of raw materials used, the proximity between the location of suppliers and manufacturing plant and other set of factors. The economies of scale can be specified as the main source of value for PepsiCo derived from inbound logistics primary activity. PepsiCo also benefits from locating its production sites within close geographical proximity to the main sources of raw materials in order to save on transportation costs. Technology is another driver of innovation that provides advantage to PepsiCo’s supply chain. One of the innovations that PepsiCo is exploring is 3D printing. For example, RUFFLES® Deep Ridged used 3-D printing technology to create optimal potato chip prototypes.[2] Operations PepsiCo operations are divided into the following the following six operational segments: Frito-Lay North America (FLNA). This segment engages in manufacturing, marketing, distributing and selling branded snack foods. Quaker Foods North America (QFNA). This segment is assigned with producing, marketing, distributing and selling cereals, rice, pasta and other branded products. Latin America segment produces markets, distributes and sells a several snack food brands for Latin American market. These brands include Doritos, Cheetos, Marias Gamesa, Ruffles, Emperador, Saladitas,Sabritas, Lay’s, Rosquinhas Mabel and Tostitos. Asia, Middle East & North America (AMENA). AMENA segment makes, markets, distributes and sells a number of leading snack food brands including Lay’s, Kurkure, Chipsy, Doritos, Cheetos and…

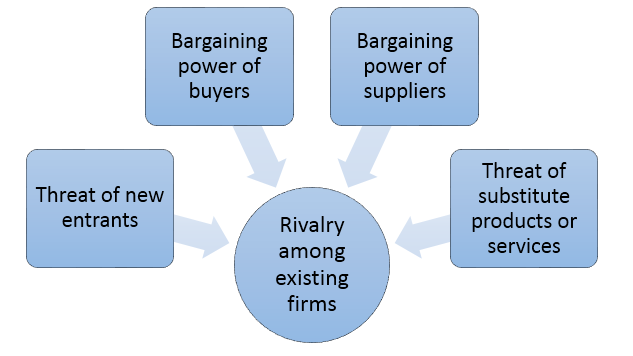

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] focus upon five separate forces that shape the overall intensity of competition in the industry. These forces are represented in Figure 1 below: Figure 1. PepsiCo Porter’s Five Forces Bargaining power of PepsiCo suppliers is insignificant. The main ingredients used by PepsiCo to produce its beverages, food and snacks include apple, orange and pineapple juice and other juice concentrates, aspartame, corn, corn sweeteners, flavorings, flour, grapefruit and other fruits, oats, oranges, potatoes, raw milk, rice, seasonings, sucralose, sugar, vegetable and essential oils, and wheat [2] PepsiCo purchases from a large number of suppliers and the bargaining power of each individual supplier is low due to the lack of uniqueness of products supplied. Furthermore, high level of importance for each supplier to have business with PepsiCo and PepsiCo’s ability to switch suppliers can be specified as important factors that reduce PepsiCo supplier bargaining power. Rivalry among existing firms is highly intensive. Beverage, food and snack manufacturing industry is highly competitive. The major brands competing with PepsiCo include but are not limited to The Coca Cole Company, DPSG, Kellogg Company, The Kraft Heinz Company, Mondelez International Inc., Monster Beverage Corporation, Nestlé S.A., Red Bull GmbH and Snyder’s-Lance, Inc. The Coca Cola Company is PepsiCo’s primary competitor and the US market share of these two brands amount to 20 per cent and 24 per cent respectively.[3] On the global scale, on the other hand, Coca-Cola has a leadership position with a market share of about 48.6 per cent compared to PepsiCo’s market share of 20.5 per cent (see Figure 2 below). Figure 2. Market share of carbonated beverages worldwide as of 2015[4] Threat of substitute products for PepsiCo is significant. The range substitutes for PepsiCo’s beverage products include tea, coffee, tap water and a…

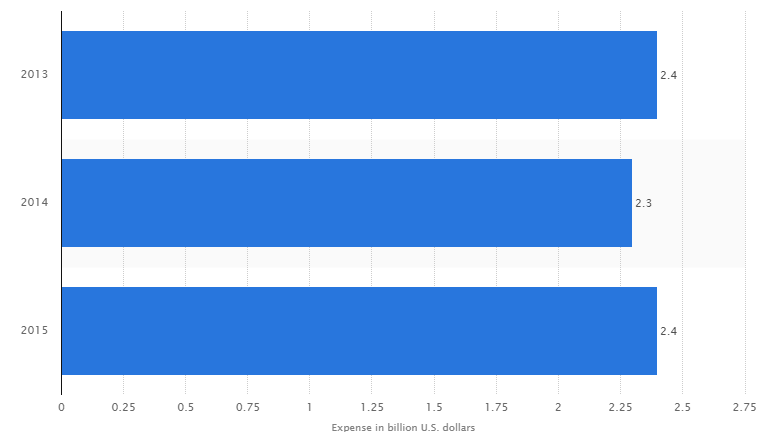

PepsiCo marketing strategy integrates a set of elements of the PepsiCo marketing communication mix as discussed further below. In 2015, PepsiCo increased its spending on advertising and marketing as a percentage of sales by 40 basis points.[1] PepsiCo marketing strategy benefits from the application of creativity and strategic collaborations. For example, in 2015 Lay’s collaborated with renowned artist Malika Favre to develop iconic illustrations for special edition packaging, promotions and activations as part of the brand’s global summer campaign.[2] PepsiCo marketing strategy also relies on celebrity endorsement to a considerable extent. The list of celebrities involved in spreading PepsiCo’s marketing message include but not limited to Usher and Serena Williams, as well as Vine and Snapchat sensation Jerome Jarre.[3] Advertising PepsiCo uses print and media advertising extensively as a traditional channel to transmit the marketing message to the target customer segment. PepsiCo print and media advertising occasionally contains comparative campaigns aimed at damaging the brand image of its main competitor – The Coca Cola Company. For example, “One ad shows a happy Pepsi drinker mocking a Coke buyer by telling him, “you’ve still got the polar bear.”[4], thus mocking Coca Cola’s the Christmas Polar Bear campaign. As it is illustrated in Figure 3 below, although the amount of PepsiCo’s advertising budget did not change significantly during the last three years, the pattern of distribution of this budget has changed. Specifically, taking into account the increasing integration of social media into personal lives of billions of customers around the globe, the company is increasingly investing its advertising dollar for social media advertisements. PepsiCo’s advertising budget As a result, PepsiCo has been able to launch a series of successful viral marketing campaigns with an evident positive implications on the brand image. For example, Pepsi Max Test Drive Prank viral video launched in…

PepsiCo 7Ps of marketing comprises seven elements of the marketing mix. These are product, place, price, promotion, process, people and physical evidence. Product. PepsiCo sells a wide range of beverages, foods and snacks under 22 different brands that include Pepsi-Cola, Lay’s, Mountain Dew, Gatorade, Tropicana, Diet Pepsi, 7UP, Doritos and other internationally famous names[1]. Although, PepsiCo senior management led by Chairman and CEO Indra Nooyi does stress the direction of the strategy towards healthy products, the majority of products within PepsiCo portfolio are beverages high in sugar and food and snacks high in salt. PepsiCo products are attractively packaged with colorful designs and they are readily available in many supermarkets and grocery stores around the globe. PepsiCo product portfolio also includes brand-related accessories, drink gears and a limited range of other products related to specific brands. However, it is important to note that the sales of these accessories account for only a small fraction of the total revenues. Place. PepsiCo products are sold in more than 200 countries and territories around the world.[2] Consumers can purchase PepsiCo products from supermarkets, mini-markets and grocery stores of various formats, restaurants and fast food restaurant chains. The company increasingly focuses on fast-food chains in order to achieve a greater level of market penetration. In 2015 alone, more than 5,000 Subway locations were added to its customer portfolio across Canada, the UK, the Netherlands and India.[3] PepsiCo does not use online sales channels to sell its food, snacks and beverages. However, PepsiCo food, snacks and beverages can be purchased online from the websites of major supermarket chains along with other products. The use of online sales channels by PepsiCo is limited to brand-related accessories, drink gears and a limited range of other products related to specific brands. Price. PepsiCo pricing strategy is market-orientated and…