Search results for: Ansoff Matrix

McDonald’s Corporation is a global fast food chain that serves more than 70 million customers in 119 countries employing about 200,000 people. McDonald’s operates two types of restaurants – company-owned and franchised restaurants with about 93% of restaurants belonging to the latter category (Annual Report, 2021) McDonald’s had disappointing financial results in 2014 with a sales growth of only 1% and a decline of operating income of 8%. Steve Easterbrook, McDonald’s Chief Brand Officer was promoted as the new CEO and President effective from March 1, 2015 to turn around the business. The list of major changes introduced by Steve Easterbrook includes reducing the use of antibiotics in chicken and massively restructuring the corporation, along with introducing changes in the menu. The turnaround efforts of the new CEO Steve Easterbrook proved to be effective with the company shares hitting record by the third quarter of 2015. However, Mr. Easterbrook was fired in 2019 due to breaching McDonald’s employee code of conduct through engaging in consent sexual relationship with female employees. New President and CEO Mr. Chris Kempczinski has proved to be effective so far, with McDonald’s emerging from COVID-19 pandemic stronger than before. In 2021, global comparable sales increased 17.0%, primarily due to strong sales performance across all segments from continued execution of the Accelerating the Arches strategy, as well as recovery from the impact of COVID-19 in the prior year. In 2021 consolidated revenues increased 21% (18% in constant currencies) to USD23.2 billion. At the same time, the fast food giant has certain weaknesses as well. These include the menu still consisting of primarily unhealthy food and the declining brand image of McDonald’s. Furthermore, the fast food chain has very high employee turnover and the company has attracted increasing negative publicity in the past few years. McDonald’s Corporation Report…

Since Amazon went public in 1997, the e-commerce giant has been repeatedly criticized for its lack of commitment on corporate social responsibility aspect of the business. Moreover, Amazon’s first sustainability executive Kara Hartnett Hurst was appointed only in August 2014 , a stark proof that CSR aspect of the business has not been paid due attention to for a long period of time. CSR Programs and Initiatives Amazon Supporting Local Communities In 2020, the e-commerce giant created the Amazon Relief Fund, with a USD25 million initial contribution, focused on supporting its independent delivery service partners and other stakeholders to deal with the negative impact of coronavirus developments on the business. Amazon’s Device Donation Program facilitates the donation of electronic devices and gift cards to schools located near Amazon fulfilment centres throughout the US The company hosts ‘Girls Who Code’ events occasionally to help get more girls interested in coding The e-commerce giant supports local and national nonprofits with cash and product donations. Amazon Educating and Empowering Workers Amazon Career Choice Program pre-pays 95% of tuition for employees to take courses for in-demand fields, such as airplane mechanic or nursing, regardless of whether the skills are relevant to a career at Amazon. Up to date the program has been attended by more than 10000 employees worldwide. Amazon Virtual Contact Centre, allows Amazon’s customer service employees to work from home. The program “Pay to Quit” offers USD 5000 to warehouse workers who quit to encourage employees to take a moment and think about what they really want.[1] Upskilling 2025 is USD 1,2 billion investment project to provide free skills training to U.S. employees. Employee Health and Safety at Amazon Amazon employs 6200 safety professionals worldwide In 2020 due to the risk of COVID-19 coronavirus, the company recommended all of global…

Amazon ecosystem of products and services is vast and it comprises retail, transportation, B2B distribution, payments, entertainment, cloud computing, and other segments. Started only as an online bookstore in 1995 by Jeff Bezos, Amazon has become the e-commerce and cloud computing tech giant consistently increasing the ecosystem of its products and services. The e-commerce giant is competent in focusing on what customers need, designing in-house innovative technology solutions and then commercialising these solutions. Amazon Web Services (AWS) is a stark example for this. This is how Amazon ecosystem has evolved. Increasing range of products and services Today, Amazon is a “retailer, a technology company, an entertainment destination, a growing advertising platform, even a delivery company with its own fleet of planes”.[1] Importantly, consumption of one type of Amazon products and services encourages the usage of other products and services offered by the company and that is the primary aim of developing an ecosystem. This can be illustrated using Alexa virtual assistant as an example. Amazon smart security camera that is compatible with the Echo smart speakers allows users to stream live video from the camera on the Echo Show or through the Alexa smartphone app. Moreover, Amazon smart glass is based on Alexa voice assistant and can be used only if the device is linked to a user’s smartphone.[2] Figure 1 below illustrates the essence of Amazon ecosystem. Figure 1 Amazon Ecosystem[3] Each of Amazon business segment illustrated in Figure 1 above plays certain role in consumption of other types of products and services belonging to the ecosystem. Let’s take Amazon Kindle for example. As it is illustrated in Figure 2 below, Amazon Fire platform can be used to consume a wide range of products and services belonging to Amazon portfolio. Moreover, Fire platform can also be used…

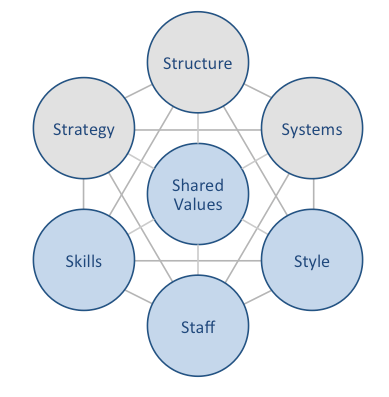

Amazon McKinsey 7S model illustrates the ways in which seven key elements of businesses can be united to increase effectiveness. According to this model strategy, structure and systems represent hard elements, whereas shared values, skills, style and staff are soft elements. McKinsey 7S model stresses the presence of strong links between elements. Specifically, it argues that a change in one element causes changes in others. As it is illustrated in figure below, shared values are positioned at the core of Amazon McKinsey 7S model, since shared values guide employee behaviour with implications in their performance. McKinsey 7S model Hard Elements in Amazon McKinsey 7S Model Strategy Amazon adheres to cost leadership business strategy. Three main pillars of Amazon business strategy are competitive prices, great range and speed of delivery. The largest internet retailer in the world has been able to sustain this strategy thanks to economies of scale, innovation of various business processes and regular business diversification. Moreover, Amazon business strategy places a great emphasis on encouraging communication among various components of its ecosystem. These components of Amazon ecosystem include merchants, writers, reviewers, publishers, apps developers, and the information market of commentators, analysts, journalists and feature writers. Additionally, customer obsession and focus on Amazon leadership values represent important cornerstones of Amazon business strategy. Structure Amazon organizational structure is hierarchical. It is difficult for the company to adapt an alternative structure such as divisional or matrix due to its gigantic size. Specifically, the e-commerce giant employs approximately 1,3 million people who serve hundreds of millions of customers worldwide.[1] The key features of Amazon corporate structure include flexibility of the business; which is unusual for a company of such a big size and stability in the top management, i.e. little turnover in the senior management team. Reliance on hybrid project…

Amazon marketing communication mix deals with individuals elements of the marketing mix such as print and media advertising, sales promotions, events and experiences, public relations and direct marketing. Amazon Print and Media Advertising Amazon uses print and media advertising extensively in order to communicate its marketing message to the members of the target customer segment. The most memorable Amazon TV ads include a video clip featuring former Top Gear host Jeremy Clarkson promoting Amazon Fire TV, a promotion deal reported to cost Amazon GBP 160 million[1]. Moreover, TV commercials promoting Amazon feature cute animals in order to associate the brand image with qualitative values. This strategy indicates to changes in Amazon marketing message in a way that “rather than hawking hardware like Kindle e-readers, furry pets are pitching Amazon’s USD 99,00 Prime membership, which features delivery discounts and media streaming”[2]. The online retail giant had also released “Mom’s Here” TV advertisement on Oprah Winfrey Network, targeting mothers for Amazon Echo. In 2019 Amazon overtook Netflix as the top advertiser for video streaming services and increased TV advertisement spending by 28% for Amazon Prime Video.[3] Print advertising is used by Amazon extensively as well via magazines, journals, newspapers and billboards. In the latest move, Amazon started to print advertisement messages, pictures and cartoon characters from “Minions” movie on its shipping boxes[4], marking the start of a new type of print advertising. One of the most memorable print advertisements by Amazon refers to the ad that appeals to Aatmanirbhar Bharat (self-sufficient India) sentiment featured in The Economic Times in 2020. This specific campaign has been praised as a successful attempt to show solidarity with nationalistic sentiment in India. Viral marketing also plays an important role in Amazon marketing strategy. Amazon is one of the earliest adopters of viral marketing and the…

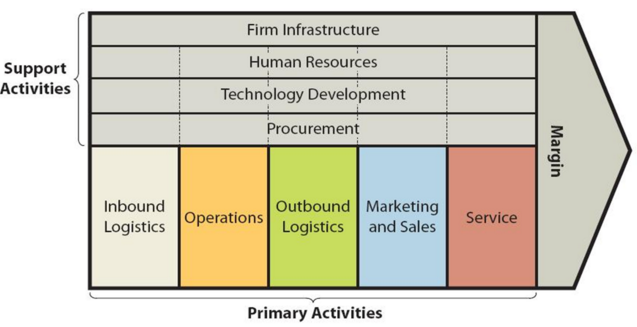

Value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the business. Figure below illustrates the essence of Amazon value chain analysis. Amazon Value chain analysis Amazon Primary Activities Amazon Inbound logistics Inbound logistics within Amazon value chain analysis involve receiving and storing raw materials to produce goods and services. Due to massive global scope of its operations the e-commerce giant maintains complex, but sophisticated inbound logistics operations. Generally, Amazon does not have long-term contracts or arrangements with its vendors to guarantee the availability of merchandise, particular payment terms, or the extension of credit limits. Fulfilment by Amazon (FBA) is the cornerstone of Amazon inbound logistics for company-owned retail business. Moreover, the economies of scale is an important source of value creation for Amazon inbound logistics. Sellers can also use FBA by stowing their inventory in Amazon fulfilment centres. In this case, Amazon assumes full responsibility for logistics, customer service, and product returns. If a customer orders an FBA item and an Amazon owned-inventory item, the company ships both items to the customer in one box, as a significant gain of efficiency. The use of FBA is an optional choice for sellers and this choice makes the products of third-party sellers eligible for Amazon Prime free two-day shipping, free shipping and other benefits. Amazon uses logistics beyond the point to serve Amazon Marketplace and starting from recently, the company has been offering logistics services to third parties. For example, Beijing Century Joyo Courier Services, an Amazon subsidiary registered with the U.S. government as an ocean shipping provider.[1] From this point of view, efficient logistics infrastructure also belongs to the list of Amazon competitive advantages. Amazon Operations Operations generally comprise the process of transforming raw materials into goods…

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape the overall extent of competition in the industry. The essence of Amazon Porter’s Five Forces is represented in figure below: Porter’s Five Forces Threat of new entrants in Amazon Porter’s Five Forces Analysis Threat of new entrants into online retail business is significant. The following sets of factors determine the threat of new entrants for Amazon’s industry. 1. Economies of scale. Amazon is the largest internet retailer and internet company by revenue in the world. The e-commerce giant operates more than 175 fulfilment centres worldwide in more than 150 million square feet of space.[2] Although potential new market entrants can copy Amazon business model, they cannot benefit from the economies of scale at the same extent as Amazon. Therefore, economies of scale can be specified as substantial barrier for new entrants. 2. Time of entry. The global market size for online shopping nearly reached USD 4 billion in 2020.[3] It has been estimated that e-commerce sales will surpass USD 740 billion by 2023 in the US alone.[4] Such an increasing popularity of internet shopping naturally attracts new entrants that will attempt to find new niches and competitive advantages. In other words, time of entry is an important factor that increases the threat of new entrants in global e-commerce. 3. Product differentiation. Amazon was able to reach its current position partly because it found an opportunity in online sales in 1994, when other companies didn’t notice or utilise such an opportunities. Likewise, other companies can find new previously unnoticed opportunities in e-retail to threaten the position of established market players such as Amazon, eBay, Alibaba and others. In other words, global e-commerce can be disrupted by start-ups that may find new sustainable sources of competitive advantage.…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. Amazon, as the e-commerce and cloud computing company worldwide needs to build upon its strengths at the same time reducing negative impact of its weaknesses on the bottom line. Moreover, it is important for the company to take advantage of opportunities and adopt a proactive approach in dealing with threats in the marketplace. The following table illustrates Amazon SWOT analysis: Strengths 1. Market leadership in the global scale 2. Strong ecosystem of products and services 3. Cost leadership due to efficient cost structure 4. Customer-centricity 5. Brand value Weaknesses 1. Business model that can be imitated 2. Seasonality of the business 3. Weak competitive position of Amazon’s Fire Phone 4. Damage to the brand image due to tax avoidance controversies in USA, UK and Japan 5. Working conditions for warehouse workers Opportunities 1. Diversification of e-commerce business segment 2. Increasing focus on own brand products and services 3. Increasing physical presence of the brand 4. Developing more local sites in international markets 5. Intensifying backward integration Threats 1. Patent infringement and other lawsuits against the company 2. Weakening of industry entry barriers 3. Threats to online security 4. Andy Jassy failing to fill Jeff Bezos shoes effectively 5. Backlash towards the brand Amazon SWOT analysis Strengths in Amazon SWOT Analysis 1. Amazon is an undisputed market leader in online retail and cloud computing segments. The e-commerce giant generated USD 386 billion revenues and earned a net income of USD 21,3 billion in 2020 alone[1]. Dubbed as The Everything Store, Amazon sells hundreds of millions of products of its own and third-party sellers. Current market leadership position grants the tech giant upper hand in the competition in a number of ways such as economies of…

Amazon marketing mix (Amazon 7Ps of marketing) comprises elements of the marketing mix that consists of product, place, price, promotion, process, people and physical evidence. Product Element in Amazon Marketing Mix (AMAZON 7Ps of Marketing) Amazon products can be divided into the following four categories: 1. Amazon websites that enable hundreds of millions of products to be sold by Amazon and by third parties across dozens of product categories. Due to the abundance of ranges of products it sells, Amazon has gained the moniker The Everything Store. In 2020 third party sellers made a profit of minimum USD 25 billion.[1] There are more than 200 million Paid Prime members.[2] 2. Electronic devices such as Kindle e-readers, Fire tablets, Fire TVs, and Echo. In 2020, customers bought tens of millions of Echo devices, and Echo Dot and Fire TV Stick with Alexa.[3] There are more than 100 million smart home devices connected to Alexa.[4] 3. Media content. An extensive range of products and services, including cloud-based services that can be used to produce content. The e-commerce giant is planning to increase the range and variety of its media content products. According to new CEO Andy Jassy it is still early days for Amazon in the media.[5] The company has reached a deal to acquire US historic movie studio MGM for USD 8,5 billion[6], as a sign of increasing focus on the media business. 4. Amazon Web Services (AWS). This segment offers a wide range of global compute, storage, database, and other service offerings. AWS serves developers and enterprises of all sizes, including start-ups, government agencies, and academic institutions. The e-commerce giant also completed the acquisition of Whole Foods Market in 2017. Place Element in Amazon Marketing Mix (AMAZON 7Ps of Marketing) Traditionally, Amazon didn’t have physical stores and the…

Amazon segmentation, targeting and positioning involves a set of activities aimed at determining specific groups of people as customers and developing products and services attractive to this group. Segmentation involves dividing population into groups according to certain characteristics, whereas targeting implies choosing specific groups identified as a result of segmentation to sell products to. Positioning refers to the selection of the marketing mix the most suitable for the target customer segment. Amazon mainly uses the following two types of positioning: Multi-segment positioning. Amazon offers a wide range of products and services, successfully exploiting more than one segment at the same time. Specifically, the online retail giant sells more than 75 million products, appealing to the needs and wants of a wide range of customer segments.[1] Adaptive positioning. The online retail giant closely monitors changes in external marketplace and addresses increasing customer expectations by periodically repositioning of products and services according to changes in the segment. Anticipatory positioning. This refers to positioning to a market segment that has low turnover with the anticipation that the turnover will increase in the future. Amazon Web Services (AWS) is a stark example for anticipatory positioning. Company’s founder and former CEO Jeff Bezos notes that “no one asked for AWS. No one. Turns out the world was in fact ready and hungry for an offering like AWS but didn’t know it”[2] Additional examples of anticipatory positioning applications by the e-commerce giant include Amazon Sage Maker, Amazon Comprehend and Amazon Rekognition. Stop-gap positioning This strategy involves investing in currently unprofitable brand due to profitability expectations on long-term perspective. The e-commerce giant applied stop-gap positioning strategy in relation to a number its brands such as Core 10, Happy Belly and Vedaka. The following table illustrates Amazon segmentation, targeting and positioning: Type of segmentation Segmentation criteria Amazon target…