Search results for: Ansoff Matrix

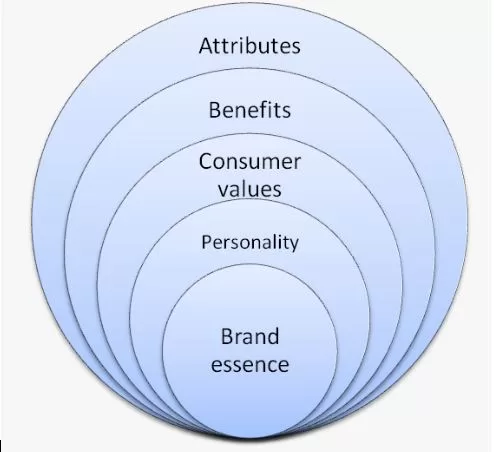

Nvidia marketing strategy is based on the following principles: – Focusing on unique selling proposition. Nvidia produces highest quality graphics processing units (GPUs) and related software, as well as, system-on-a-chip (SoC) products for various platforms. Nvidia unique selling proposition is associated with the superior performance of its products and the company communicates this value proposition to the target customer segment through various marketing communication channels. – Usage of channel marketing. The multinational technology company has strategic collaboration in place with its channel partners such as system integrators and OEMs. This collaboration is important to pass the marketing message about advanced product features and capabilities to end-users. – Content marketing. Marketing strategy of Nvidia makes a great use of content marketing. Specifically, the company educates their potential customers about advanced features and capabilities of their products through YouTube videos, blog articles, whitepapers, and case studies. Nvidia marketing strategy can be also explained through the application of Brand Essence Wheel Model. Nvidia brand essence is the core and overall image of the company and it has the following important elements: – Attributes are verifiable facts about the company. Nvidia is one of the largest GPU producers in the world. The US-based company has been in the business for more than 30 years. – Benefits relate to the tangible points of differentiation. Nvidia customers benefit from attractively designed GPUs and other related products that offer highly advanced features and capabilities. Brand Essence Wheel – Consumer values are elements that company celebrates and promotes. For the US-based the multinational technology company it includes innovation, effectiveness, diversity and inclusion. – Personality refers to a set of human characteristics that can be applied to brands. Nvidia brand personality is associated with being dynamic and sophisticated. Nvidia Corporation Report contains the above analysis of Nvidia…

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. Nvidia PESTEL analysis involves the analysis of potential impact of these external factors on the bottom line and long-term growth prospects of the multinational technology company. Political Factors in Nvidia PESTEL Analysis There is a host of political factors that can affect Nvidia. These include geopolitical tensions, government incentives and regulations, corruption, freedom of press, trade union activities and others. Moreover, the extent of bureaucracy, government tariffs and trade controls, as well as, tax policies can also have implications on the performance of the multinational technology company. Government intervention Nvidia had to experience the effect of an external political factor of government intervention into its growth plan. The company had to abandon the acquisition plan of chip technology company ARM for USD 40 billion from Soft Bank after an investigation from UK’s Competition & Markets Authority and the US Federal Trade Commission sued to block the proposed merger due to the concerns that combined firm to stifle competing next-generation technologies.[1]. The multinational technology company is not immune from such interferences in the future as well. US-China Tech War Nvidia had to bear the collateral damage due to US-China tech war during the past few years. The world’s most valuable semiconductor company has been blocked from selling its most advanced chips — the H100 and A100 series — to Chinese customers since August when the US imposed export controls on technology used for AI. Nvidia has been forced to reconfigure some of its chips to comply with US rules limiting the performance of products sold in China. It is not the first instance where Nvidia and other major technology companies have been affected by so called tech war between…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Nvidia SWOT analysis: Strengths 1. Global leadership in GPU market 2. Unique position to benefit from increasing popularity of AI 3. More than 370 partnerships revolving around self-driving cars 4. Advanced R&D capabilities Weaknesses 1. Dependency of the majority of profits on graphics cards alone 2. Dependence on 3rd parties due to fabless manufacturing 3. High operational costs 4. Limited product differentiation. Opportunities 1. Benefiting from increasing popularity of AI 2. Acquisitions of other technology companies 3. Expansion into new industries 4. Growth in the cloud computing market Threats 1. Intensifying competition 2. Supply chain disruptions 3. Regulatory changes 4. Disruptive innovation Nvidia SWOT analysis Strengths in Nvidia SWOT Analysis 1. Nvidia is the global leader in GPU market with market share of more than 70%. The company has benefited from the first mover advantage. Nvidia’s GeForce 256 is widely considered the world’s first GPU. Furthermore, at the moment Nvidia GeForce RTX 3090 TI is considered as the best-performing GPU in the world.[1] The global market leadership is a considerable strength for the multinational technology company in terms of brand image and revenue potential. 2. Nvidia produces advanced chips required to train and run artificial intelligence (AI) networks and as such the company hugely benefiting from the increasing integration of AI into various aspects of personal and professional lives for millions of people. Other competitors such as AMD, Cisco and Juniper also set to benefit from AI, however, Nvidia in particular had made earlier bet and the company currently has become synonym with AI. Furthermore, on May 30, 2023 Nvidia market capitalization crossed USD 1 trillion threshold for the 1st time after its artificial intelligence prospects vaulted the chipmaker into an elite club…

Nvidia organizational culture integrates the following key elements. 1. Innovation. Nvidia is one of the most innovative companies in the world and its organizational culture promotes the spirit of creativity for innovation among employees at all levels. The company encourages employees to think outside the box and come up with new and creative solutions to problems. Consistently producing innovative products and services is a business strategy for NVIDIA and therefore, the company systematically attempts to integrate innovation into the DNA of its organizational culture. 2. Intellectual honesty. The co-founder and long-term CEO Jensen Huang has served as a role model in integrating intellectual honesty within Nvidia organizational culture. For Huang intellectual honesty is critically important to admit mistakes and failures and tolerating them to foster creativity and innovation. Jensen Huang came to appreciate the value of intellectual honesty early on in his career as a head of Nvidia. The first ever product produced by Nvidia simply did not work costing huge amount of investments. It was at that time Huang acknowledged the failure and started everything from the beginning. 3. High-performance. Organizational culture of Nvidia promotes high performance among employees through creating relaxed environment for employees to work. The absence of office politics and hierarchy motivates employees to perform at their best. 4. Inclusion and diversity. CEO Jensen Huang has placed inclusion and diversity at the core of Nvidia organizational culture. Diverse employees at NVIDIA score the company 78/100 across various culture categories, placing NVIDIA in the top 10% of companies on Comparably with 10,000+ Employees for Comparably’s diversity score[1]. Nvidia Corporation Report contains the above analysis of Nvidia organizational culture. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and…

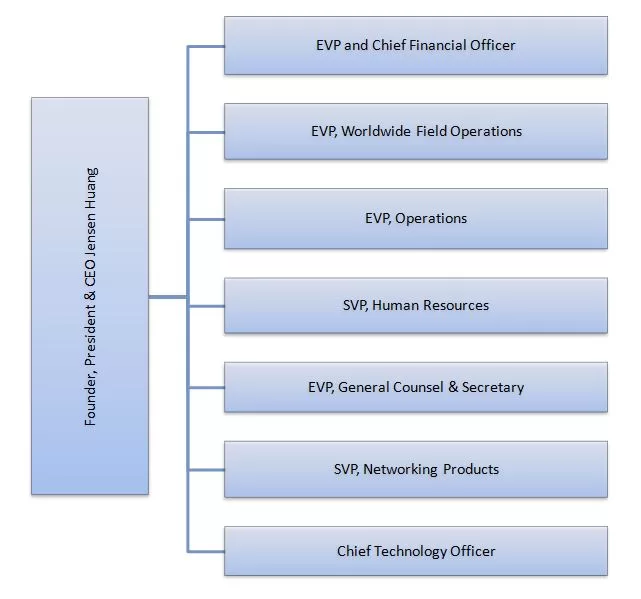

Nvidia is 7th largest company in the world with a market cap of USD 1 trillion. Due to the size and scope of its operations, it is difficult to categorise Nvidia organizational structure within a certain group. However, it is evident that the tech company uses certain elements of functional and hybrid organizational structure. The multinational technology company divides its business practices into various functions such as engineering and product development, supply chain and operations, human resources, finance and accounting and legal and compliance. Functional organizational structure provides a range of advantages for Nvidia. Specifically, employees are assigned into groups on the basis of their competencies and expertise. This allows the groups to achieve their goals with high level of efficiency. Furthermore, functional organizational structure is associated with clear reporting lines and this can enhance the speed and quality of decision making at Nvidia. Nvidia also has certain components of matrix organizational structure in place. Temporary product or project groups are often formed within the multinational technology company and group members report to both, group leader, as well as their direct superiors within the organizational structure. The figure below illustrates the corporate structure of Nvidia: Nvidia Organizational Structure Nvidia Corporation Report contains the above analysis of Nvidia organizational structure. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Nvidia. Moreover, the report contains analyses of Nvidia leadership, business strategy and organizational culture. The report also comprises discussions of Nvidia marketing strategy, ecosystem and addresses issues of corporate social responsibility.

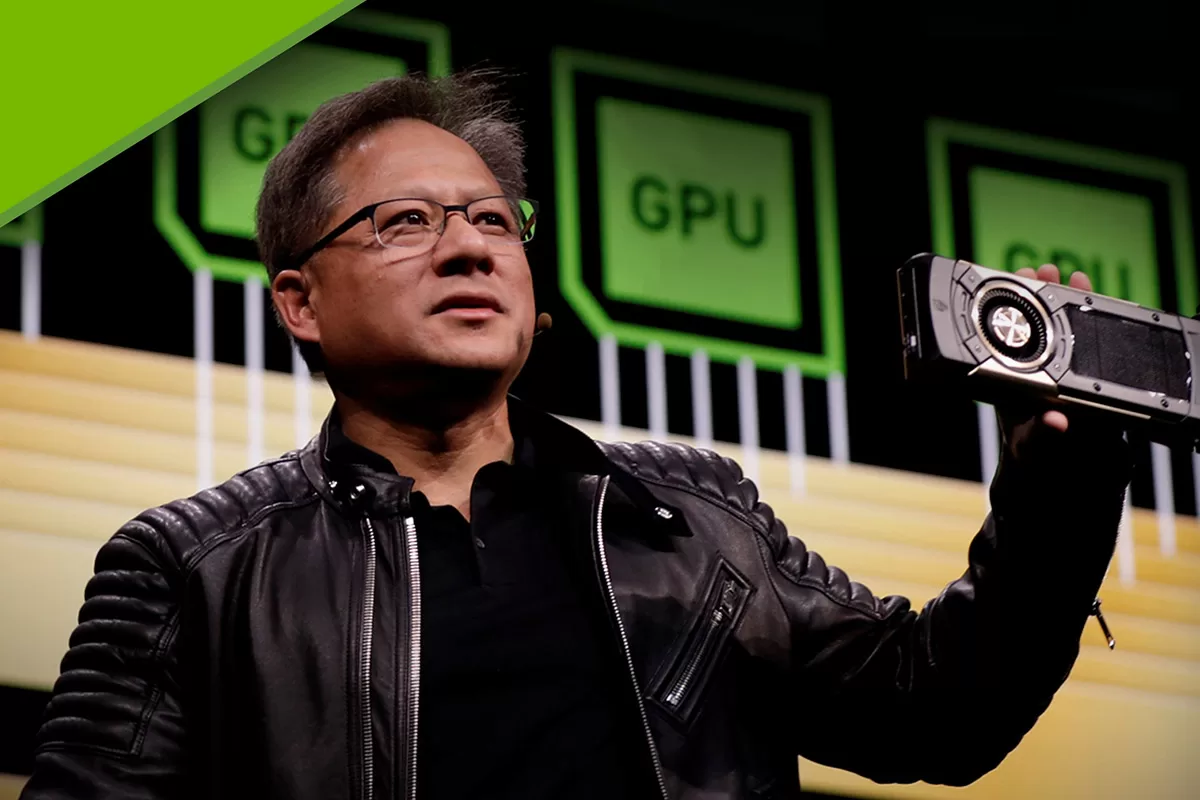

Leadership style at Nvidia is based on the vision and values of its co-founder and long-term CEO Jensen Huang. The leather jacket-clad CEO has been at the helm of Nvidia leadership since 1993. Huang is known for his charismatic leadership style and his ability to inspire and motivate his team. He is deeply involved in the day-to-day operations of the company and is known for his hands-on approach to management. Huang does most of the company-wide presentations and product announcements himself wearing his iconic leather jacket. The CEO is also a strong advocate for innovation and is committed to pushing the boundaries of what is possible with technology. One of Huang’s key strengths as a CEO is his ability to anticipate emerging trends and opportunities in the technology industry. He was an early champion of the potential of graphics processing units (GPUs) for high-performance computing, and he has been instrumental in driving Nvidia’s success in this area. He has also been a vocal advocate for the use of AI in a wide range of applications, from self-driving cars to medical research. Moreover, Huang is known for his ability to build strong partnerships with other companies and to work collaboratively with his team. He has fostered a culture of innovation and excellence at Nvidia, and he is deeply committed to supporting the growth and development of his employees. Celebrating failures is an important element of leadership style at Nvidia. Soon after Huang started the company in 1993, raised the capital and employed 100 people, the technology they developed did not work. Nevertheless, Huang was able to turn around the company by developing new products and the early experience played an important role in cementing corporate culture of intellectual honesty and taking risks. Nvidia Corporation Report contains the above analysis of Nvidia…

NVIDIA business strategy is based on a platform strategy, bringing together hardware and systems, software, algorithms and libraries, and services to create unique value for the markets it serves. The company specializes in markets in which its computing platforms can provide great acceleration for applications. These platforms include processors, interconnects, software, algorithms, systems, and services to deliver unique value. Nvidia business strategy consists of the following three main elements: 1. Benefiting from the first mover advantage. The multinational technology company has benefited from the first mover advantage numerous times to solidify its position in the market. For example, it popularized the term GPU (graphics processing unit), developed Computer Unified Device Architecture (CUDA) and invented deep learning hardware accelerators, such as the Tesla V100 and T4 GPUs. Benefiting from the fist mover advantage is the core of Nvidia business strategy. 2. Prioritizing performance of products over their costs. Nvidia follows product differentiation business strategy and accordingly focuses on superior performance of its products and services over their costs. In other words, the company’s GPUs, data centre and gaming solutions, Drive and Jetson platforms and professional graphics solutions have the most advanced functions and capabilities, but these come at an additional cost for customers. 3. Vertical integration. The company designs and manufactures its own GPUs and other hardware components through fabless manufacturing, and it develops its own software solutions to optimize performance and enable new applications. Nvidia Corporation Report contains the above analysis of Nvidia business strategy. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Nvidia. Moreover, the report contains analyses of Nvidia leadership, organizational structure and organizational culture. The report also comprises discussions of Nvidia marketing strategy, ecosystem…

Founded in 1993 by Jensen Huang, Chris Malachowsky and Curtis Priem, Nvidia Corporation is the multinational technology company that aims to solve the world’s visual computing challenges. The GPU maker is the 7th largest company in the world with a market cap of around USD 1 trillion. For fiscal year 2022 the revenue was a record USD 26.91 billion, up 61 percent from USD 16.68 billion a year ago. Gross margins expanded to 64.9 percent, and earnings per share were USD 3.85, up 123 percent from a year ago (Annual Review, 2022) Nvidia business strategy involves benefiting from the first mover advantage, prioritizing performance of products over their costs and pursuing vertical integration. The company’s co-founder and CEO of 30 years Jensen Huang is famous for his charismatic leadership style and his ability to inspire and motivate his team. The multinational technology company has functional and hybrid organizational structure and divides its business practices into various functions such as engineering and product development, supply chain and operations, human resources, finance and accounting and legal and compliance. Nvidia organizational culture integrates the elements of innovation, intellectual honesty, high performance and inclusion and diversity. Within the framework of Ansoff Grow Matrix the company uses all four growth strategies – market penetration, product development, market development and diversification in an integrated manner. The world’s most valuable semiconductor company possesses certain strengths such as global leadership in GPU market, unique position to benefit from the increasing popularity of artificial intelligence (AI) and more than 370 partnerships revolving around self-driving cars. Furthermore, Nvidia possesses advanced R&D capabilities and these allowed the company to reach its current state. At the same time, the software and fables company has serious weaknesses that need to be addressed. At the moment Nvidia depends on a single type of product…

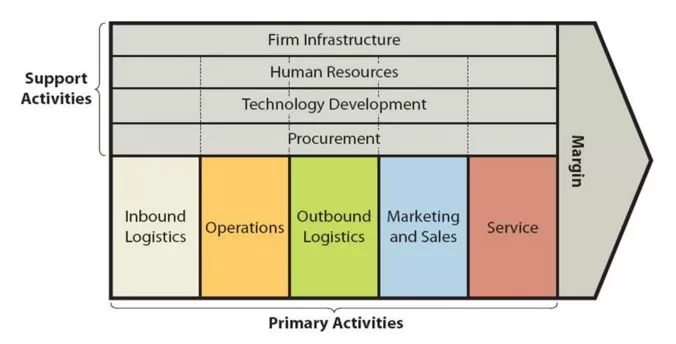

WeWork value chain analysis is an analytical framework that assists in identifying business activities that can create value and competitive advantage to the co-working giant. Figure below illustrates the essence of WeWork value chain analysis. WeWork Value Chain Analysis WeWork Primary Activities WeWork Inbound logistics Generally, inbound logistics involve receiving and storing raw materials and using them for manufacturing. WeWork offers space as a service and as such its value chain analysis, including inbound logistics are affected by the following main characteristics of service: a) Inseperability. In services production and consumption are simultaneous and they cannot be separated. b) Intangibility. Unlike products, services are intangible and they cannot be touched in physical terms. However, intangibility aspect of services relates to WeWork to a lesser degree compared to other types of services. This is because office spaces and furniture and appliances within offices are tangible items. c) Perishability. Services cannot be stored for the later use or sale. Certain number of desks of a co-working operator staying vacant during a certain period of time means waste and loss for the business. d) Heterogeneity. It is difficult to establish a standard for the quality of services. The quality of services is highly dependent on the perception of each individual user. Inbound logistics for WeWork involve finding suitable places for co-working offices and furnishing these offices as creative and attractive workspaces. WeWork Operations Operations within value chain analysis refer to the process of transforming raw materials into products ready to sell. For service companies such as WeWork operations include the processes that make the services possible and deliver the experiences to consumers. WeWork operates a network of 756 locations in 38 countries as of December 2021[1]. The co-working giant attempts to design its offices and workspaces in a creative manner that…

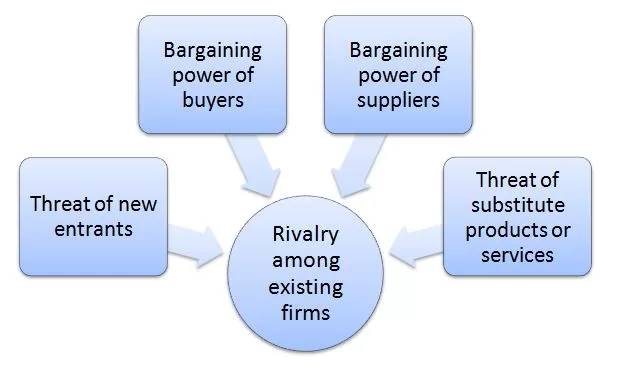

Porter’s Five Forces analytical framework developed by Michael Porter (1979)[1] represents five individual forces that shape an overall extent of competition in the industry. WeWork Porter’s Five Forces is illustrated in figure below: Porter’s Five Forces Threat of new entrants in WeWork Porter’s Five Forces Analysis Threat of new entrants into the flexible workspace industry is significant. The following are the major factors that affect the threat of new entrants into the flexible workspace industry. 1. Time of entry. Increasing numbers of start-ups and solopreneurs are increasing demand for flexible workspace. Furthermore, COVID-19 pandemic has proved the inefficiency of committing to long-term traditional real estate lease agreements for many businesses. Instead, companies of all sizes increasingly prefer to flexible workspace to accommodate their changing needs for desks throughout the year. This tendency may motivate new players to enter the industry. 2. Massive capital requirements. Leasing real estate and furnishing them into creative open space is expensive. Investors may not be keen to finance such business proposals due to low profit margins and long payback periods of their investment. Massive capital requirement is a serious barrier for new entrants. WeWork’s co-founder and former CEO Adam Neumann was able to raise billions of dollars for the business by positioning the company as an internet technology company, rather than real estate company it is. 3. Lack of technological barrier. Unlike technological and manufacturing businesses there are no know-how barriers to enter the flexible workspace industry. There is no secret formula or advanced software a company needs to develop to enter the industry. Massive capital requirement is the only barrier and the absence of other barriers may attract new players into the industry. Bargaining power of buyers in WeWork Porter’s Five Forces Analysis The bargaining power of buyers in flexible workspace sector…