Strategy

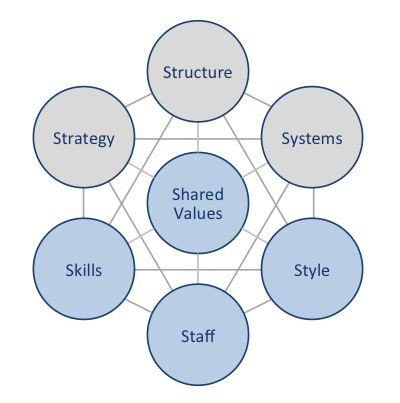

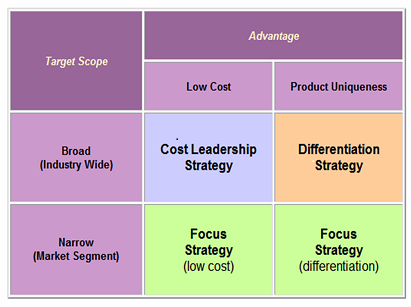

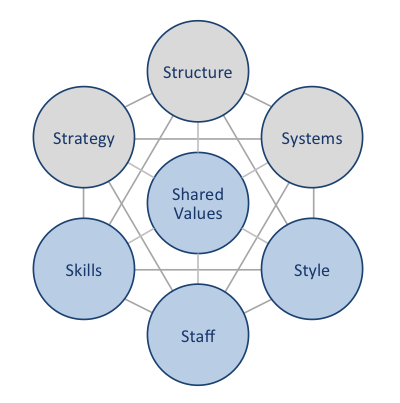

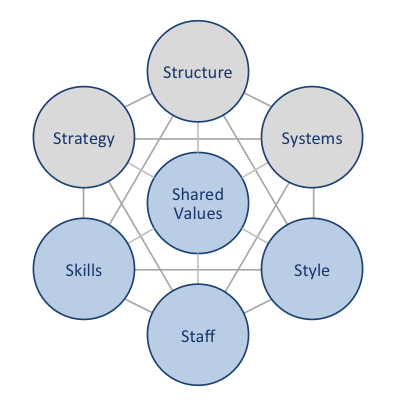

Tesco McKinsey 7S model illustrates the linkage between seven separate elements of the business to increase the overall effectiveness. According to this model, businesses have hard and soft elements and shared values as soft element are the result of interaction of all elements with direct and huge effects on employee behavior and performance. Tesco McKinsey 7S Framework Hard Elements Strategy. Tesco pursues cost leadership business strategy according to its marketing communication message Every Little Helps. The supermarket chain has been able to sustain this strategy due to the extensive exploitation of the economies of scale and the exercise of bargaining power in dealing with suppliers to secure low purchasing costs. Currently, Tesco is dealing with a set of complex challenges such as restoring customer trust following profit accounts scandal, supplier payment delays scandal and dramatic decline of sales as a result of these incidents. Tesco strategy to deal with these issues as announced by its new CEO Dave Lewis include the reduction of capital expenditure to GBP 1 billion, replacement of the benefit pension scheme for all employees and the review of property portfolio with the aim of cost reduction. Moreover, a focus on availability, service and selectively on price emerged as a strategic priority for the new management. Structure. Tesco’s organizational structure is highly hierarchical and comprises many layers of management from store sales assistant to the CEO. The new CEO Dave Lewis eliminated the roles of deputy store managers in 2015 as part of attempts to simplify the organizational structure. There are 10 members in The Board of Directors and the company’s Executive Committee comprises 11 members. Systems. The supermarket chain relies on a wide range of systems on a daily basis to sustain its operations. New management led by CEO Dave Lewis announced plans to simplify organizational…

Executive Summary This article represents a business plan sample for Product Placement Opportunities®, a marketing services company that provides a platform for medium sized businesses to engage in product placement in a cost-effective manner through its website www.pp-opportunities.com. The business plan sample is built upon the gap in the in the marketing services industry that relates to allowing media, special event and computer games businesses to utilise their product placement opportunities in a direct manner, without using the services of marketing agencies. The comprehensiveness of the business plan sample is ensured by explaining mission statement, business strategy and objectives in a detailed manner. The main source of revenue for Product Placement Opportunities® relates to charging media, special event and computer games and other businesses for adverting their product placement opportunities on www.pp-opportunities.com. Price skimming pricing strategy has been chosen as the most suitable for the business. Analysis of principal personnel qualifications and experience contained within the plan highlights the ways in which competitive advantages are going to be derived. Moreover, cash flow forecast, profit and loss accounts forecast and balance sheet associated with the business plan have been developed on the basis of situational analysis and analysing market size for Product Placement Opportunities® services. The business plan sample also contains discussion related to relevant legal requirements, such as the company’s legal structure, commercial dealings, insurance and others. Glossary of Terms Business plan – “a document that sets out the basic idea underlying a business and related startup considerations” (Longenecker et al, 2005, p.117) Product placement – “an advertising technique used by companies to subtly promote their products through a non-traditional advertising technique, usually through appearances in film, television, or other media” (Business Dictionary, 2016, online) Organisational mission – “organisation’s fundamental purpose for existing, defining who the organisation is, its values, and the…

1. Introduction Fordism can be defined as “a set of principles that includes technological measures, especially mass production on the assembly line, as well as economic strategies such as supporting mass consumption by lowering prices and increasing wages”[1]. The term is coined by Antonio Gramsci after the name of Henri Ford, a famous US industrialist and the founder of Ford Motor Company. The concept of Fordism has developed starting from 1910’s to reach its peak in the period between 1940’s to 1960’s. Fordism is closely associated with the notions of mass production and consumption. Prior to mass production assembly lines introduced initially in Ford factories, products were manufactured with the method of craft production, which involved the same workers being engaged in the many stages of manufacturing processes. The consumption point of Fordism stems from Henri Ford’s belief that company employees need to be able to purchase cars produced by Ford, thus the level of their wages were increased. Thus, it can be reasoned that “Model T, sold in millions, can be viewed as the herald of consumerism, the new phase in human history when consumption came to be seen no just as the means of survival but as the true path to the good and happy life”[2]. This article represents a critical evaluation of the concept of ‘Fordism’ within the settings of international political economy a range of related issues. The article starts with discussions about the evolution of Fordism. This is followed by critical assessment of the concept within modern international political economy. Moreover, the article contains a reflection of criticism associated with Fordism and analysis of circumstances that enabled emergence of Neo-Fordism. 2. Evolution of Fordism It has been argued that Fordist method of mass production primarily owes to the teachings of Taylorism, which has created…

Tesco business strategy can be described as cost leadership and its motto ‘Every Little Helps’ guides its business strategy to a considerable extent. Economies of scale is one of the main competitive advantage extensively exploited by Tesco due to the vast scale of its operations. Tesco business strategy has traditionally involved experimentation with various aspects of the business and this strategy changed the overall retail industry in the UK to a certain extent. For example, Tesco was the first retailer to introduce 24-hour shopping experience and today it has thousands of Click & Collect points across the country.[1] Tesco business strategy for the short-term is aimed at regaining stakeholder trust in general and customer trust in particular following commercial income reporting scandal in 2015. The senior level management has announced that this objective will be achieved via the following set of initiatives: Focusing on availability, service and selectively on price Undertaking a significant programme of restructuring and financial discipline Launching a programme of renewal to restore trust in every aspect of the brand Moreover, as an outcome of income reporting scandal combined with a set of other factors, Tesco is currently in a difficult financial position with a total leverage debt of GBP 22 billion and the net debt of GBP 8.5 billion.[2] The following initiatives have been introduced by the senior level management in order to reduce the volume of debt: Not paying final dividends to shareholders for the financial year 2014/15 Reducing the amount of capital expenditure to GBP 1 billion Replacing defined benefit pension scheme for all employees Reviewing Tesco’s property portfolio, including leases that amount to GBP 1.5 billion annual rent bill The sale or closure of all three Blinkbox businesses (movies, music and books) and Tesco Broadband Tesco PLC Report contains more detailed discussion of…

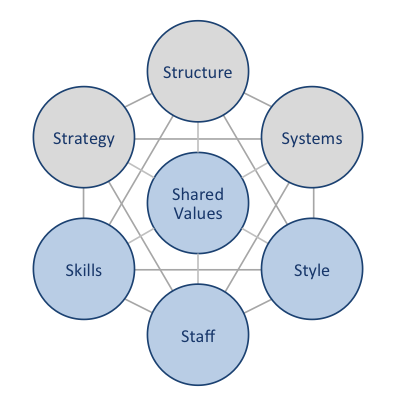

PepsiCo McKinsey 7S framework explains how important elements of businesses can be aligned to increase the overall effectiveness. According to McKinsey 7S framework, strategy, structure and systems are hard elements, whereas shared values, skills, style and staff represent soft elements of businesses. The essence of the framework can be explained in a way that a change in one element causes changes in others. As it is illustrated in Figure 1 below, shared values are positioned at the core of PepsiCo McKinsey 7S framework, since shared values guide employee behavior with implications in their performance. Figure 1 McKinsey 7S Framework Hard Elements Strategy. PepsiCo business strategy integrates the following six principles: Achieving growth through mergers and acquisitions (M&A) Forming strategic alliances in global scale Focusing on emerging markets Focusing on organizational culture Developing and promoting the idea of One PepsiCo Innovation in marketing initiatives Moreover, as it is illustrated in Figure 2 below, the level of consumption of carbonated drinks in the US has been consistently declining for the last ten years and this tendency is expected to continue for the foreseeable future. PepsiCo strategy reflects this important tendency and accordingly, the company has been increasing its portfolio to include food and snacks product categories to decrease the dependency of the business on sodas and carbonated drinks. Figure 2 The decline of millions of liters of soda sold in the US[1] Along with strong financial performance, numerous customer awards is a convincing indicator of appropriateness and effectiveness of PepsiCo business strategy. The list of awards won during the year of 2015 alone include Innovation Supplier of the Year from 7-Eleven, Vendor of the Year from Dollar General, the Think Customer Award from CVS, Supplier of the Year from Target, and Food & Beverage Supplier of the Year from Walmart.[2] Structure. PepsiCo has…

PepsiCo mission statement has been worded by CEO Indra Nooyi as ‘Performance with Purpose’ and this principle is closely integrated with the strategic direction chosen for the company. The most prominent aspects of PepsiCo business strategy are based on the following six principles: First, achieving growth through mergers and acquisitions (M&A). M&A can offer the advantages of gaining access to competencies and infrastructure, reducing direct costs and overheads and achieving organic growth. Recently, PepsiCo has completed as a set of important acquisitions such as acquisition of juice and diary businesses Lebedyansky and Wimm-Bill-Dann in Russia, Lucky snacks and Mabel cookies in Brazil, and Dilexis cookies in Argentina. M&A can be specified as one of the cornerstones of PepsiCo business strategy. As a result of an aggressive pursuit of this strategy, today PepsiCo portfolio comprises 22 brands and each of these brands have generated at least one billion USD in retail sales in 2015.[1] Second, forming strategic alliances in the global scale. Specifically, strategic partnerships have been formed with Tingyi in China in order to claim a share in growing beverage market in China. Moreover, formation of a joint-venture with Tata in India to enhance drinking water manufacturing capabilities, and initiation of strategic partnership with Almarai in Saudi Arabia can be mentioned to illustrate PepsiCo’s adoption of strategic alliances as an integral part of the corporate strategy. Important strategic alliances are formed by PepsiCo at home markets as well. Specifically, by forming a strategic alliance with Starbucks – a global coffee house chain, PepsiCo has been able to claim its share from increasing energy drink market segment. Third, focusing on emerging markets. An aggressive pursuit of this strategy has had positive impact on the bottom line. The year of 2015 witnessed a double-digit growth in the sales of snacks in China and…

PepsiCo Inc. is a US-based global food, snack and beverage company that was incorporated in Delaware in 1919 and reincorporated in North Carolina in 1986. Today, PepsiCo brand portfolio includes a range of globally famous brand names such as Pepsi, Lays, Lipton, Doritos, Tropicana, Walkers, Miranda, Cheetos and others. In total, PepsiCo portfolio comprises 22 brands and each of these brands have generated at least one billion USD in retail sales in 2015. Products belonging to PepsiCo portfolio are consumed about one billion times each day in more than 200 countries and territories (Annual Report, 2015). PepsiCo’s mission statement is formulated as “to provide consumers around the world with delicious, affordable, convenient and complementary foods and beverages from wholesome breakfasts to healthy and fun daytime snacks and beverages to evening treats” The company employs 263,000 people globally, including approximately 110,000 people within the United States. In 2015, PepsiCo achieved 5 per cent organic revenue growth with a cash flow of more than USD 8.1 billion. About 53 per cent of net revenues were generated from food business, whereas net revenues generated from the beverage businesses amounted to 47 per cent (Annual Report, 2015). PepsiCo has major impact in the US economy. The company has been acknowledged as the Number One contributor to retail sales growth in the U.S. in 2015, generating more growth than the next 15 largest food and beverage manufacturers combined. PepsiCo Report contains the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis and McKinsey 7S Model on PepsiCo. Moreover, the report contains analyses of PepsiCo’s business strategy, leadership and organizational structure and its marketing strategy. The report also discusses the issues of corporate social responsibility. 1. Introduction 2. Business Strategy 3. Leadership and Organizational Structure…

BMW McKinsey 7S framework illustrates the manners in which seven elements of businesses can be aligned to increase effectiveness. McKinsey 7S framework recognizes strategy, structure and systems as hard elements, while shared values, skills, style and staff are accepted as soft elements. According to the framework, there are strong links between elements in a way that a change in one element causes changes in others. As it is illustrated in Figure 13 below, shared values are positioned at the core of BMW McKinsey 7S framework, since shared values guide employee behavior with implications in their performance. McKinsey 7S Framework Hard Elements Strategy. BMW Group business strategy can be described as product differentiation and accordingly, the company positions itself as a premium brand in an automobile industry. BMW Group pursues differentiation business strategy with a focus on advanced technological features and capabilities and digitalization of its vehicles according to its Strategy Number One. Moreover, the company strategy attempts to associate ownership of BMW Group vehicles with personal achievement and the representation of high status. The company communicates relevant marketing messages to the target customer segment via various marketing communication channels. Structure. BMW Group organizational structure is complex due to the size of the company and the massive scope of its operations. Yet, BMW organizational structure is sophisticated enough to respond to changes in the external marketplace in a timely manner. BMW AG Supervisory Board is the highest strategic management team with members organized into four committees. These are Personnel, Audit, Nomination and Mediation committees. BMW AG Supervisory Board oversees BMW AG Board of Management headed by its Chairman Harald Krüger. Systems. These relate to daily activities and procedures engaged by BMW Group employees in order to get their job done. BMW Group integrates robotics technology, IT and online platforms within its…

BMW business strategy can be characterized as product differentiation with a particular focus on design and digitization. Electromobility represents the latest direction for BMW Group product differentiation and the company introduced its fully electric BMW i3 in 2013. This has been followed by plug-in hybrid vehicle BMW i8 in 2014. Moreover, BMW business strategy focuses on individual mobility in the premium segment – combined with attractive mobility services.[1] The company stays loyal to Strategy Number One which strives to align high levels of profitability in short-term perspective with increasing the levels of long-term value of the company in times of change. Four strategic areas for BMW have been specified as “Growth”, “Shaping the Future”, “Profitability” and “Access to technology and customers” BMW Group competitive advantage is based on the following points: 1. Representation of status and achievement. BMW belongs to premium car categories, and accordingly, possession of a BMW model car can be interpreted as a sign of achievement and social status in a society. 2. Effective design and features integrated to each model of the brand. These common design and effective features include, but not limited to the two-section, rounded radiator grille, attractive aesthetics, sophisticated style, and Hofmeister kink, i.e. the counter curve in the window-outline at the base of the rear roof pillar. 3. Competitive post-sales service. BMW received positive acclaim for superior after-the-sales customer service and this fact is greatly valued by customers. Research and development (R&D) plays an integral role in sustainability of BMW competitive advantage and this fact is duly recognized by the senior management. In 2015, R&D investments were increased by EUR 136 million to more than EUR 4.2 billion[2]. It has to be noted that BMW competitive advantage is challenging to sustain in the long-term perspective because sustainability of competitive advantage depends on the…

Walmart McKinsey 7S framework illustrates the ways in which seven elements of businesses can be aligned to increase effectiveness. According to the framework strategy, structure and systems represent hard elements, whereas shared values, skills, style and staff are soft elements. McKinsey 7S framework stresses the presence of strong links between elements in a way that a change in one element causes changes in others. As it is illustrated in Figure 10 below, shared values are positioned at the core of Walmart McKinsey 7S framework, since shared values guide employee behavior with implications in their performance. Hard Elements Strategy. Walmart pursues cost leadership business strategy according to its brand promise of ‘everyday low prices’. The company has been able to sustain this strategy thanks to the economies of scale, exercise of its vast bargaining power to secure low prices from suppliers and paying employees low wages. Three important pillars in Walmart business strategy can be specified as – assortment, price and access. Due to its aggressive pursuit of cost leadership strategy, Walmart has attracted criticism for paying its employees low wages with a consequent negative impact on the quality of customer services. CEO Doug McMillion had to address this issue via introducing certain changes in Walmart business strategy. Specifically, in February 2015, the company announced a USD1 billion investment in U.S. hourly associates to provide higher wages, more training and increased opportunities to build a career with Walmart.[1] Structure. Traditionally, Walmart organizational structure has been highly hierarchical due to the massive size and scope its business that comprises more than 11,000 stores in 27 countries and serves nearly 260 million customers each week under 72 banners.[2] However, new CEO Doug McMillion introduced initiatives to delayer the organizational structure. Specifically, in 2015 Walmart announced that “it will eliminate a layer of management…