SWOT Analyses

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Gap Inc. SWOT analysis: Strengths 1. A strong portfolio of distinct brands across multiple channels 2. Global presence of the brand 3. Presence of timeless iconic products 4. Strategic supplier relationships Weaknesses 1. Declining sales and profits 2. Failure to utilize online sales channels efficiently 3. Dependency on external manufacturers 4. Loss of ‘coolness’ to a certain extent during the past five years Opportunities 1. Increasing the efficiency of online sales 2. International market expansion focusing on Asia 3. Celebrity endorsement 4. Formation of strategic alliances Threats 1. Further decline of sales and profits 2. Risks related to global sourcing and manufacturing 3. Inability of the management to turn around the business 4. Further increase in the cost of labor Gap Inc. SWOT analysis Strengths Gap Inc.’s portfolio comprises Gap, Banana Republic, Old Navy, Athleta, and Intermix brands, addressing the needs of different customer segments within clothing and fashion industry. Gap is associated with optimistic American casual style, whereas Athleta offers performance and lifestyle apparel for the fitness-minded woman. Moreover, there is a range of Gap sub-brands such as GapKids, GapBody, GapMaternity, GapFit and babyGap that effectively appeal to the needs and preferences of relevant customer segments. Gap Inc’s current strong portfolio of distinct brands is a considerable strength from a viewpoint of appealing a wider customer segment with positive implications on the volume of revenues. Gap Inc. is a global company with almost 3,700 stores worldwide, including company-operated stores in the United States, Canada, the United Kingdom, France, Ireland, Japan, China and Italy, and franchise stores in Asia, Australia, Europe, Latin America, the Middle East and Africa.[1] The global presence of the brand plays an integral role in terms of market…

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates eBay SWOT analysis: Strengths 1. First mover advantage 2. Sophisticated infrastructure and the global scale of operations 3. Brand value 4. Organizational culture of experimentation and entrepreneurship Weaknesses 1. Dependence on products and services controlled by competitors 2. Complexity of business model 3. Lack of clear business strategy and competitive advantage 4. Absence of own distribution network Opportunities 1. Making a disruptive innovation in online retail industry 2. Engaging in business diversification 3. Formation of strategic alliances 4. Engaging in acquisitions Threats 1. Inability to compete with Amazon as online retailer 2. Breach of security 3. Crash of the website 4. Patent infringement and other lawsuits against the company eBay SWOT analysis Strengths First mover advantage has been traditionally a major strength for eBay. Apart from being the first platform in the world for online auctions, eBay has a first mover advantage in a range of areas such as Seller Performance Standards, eTRS, Verified Rights Owner Program and Feedback Forum. Particularly, the first mover advantage in online auctions has enabled the company to become a multi-billion company within a matter of a few years and ensured market leadership of the business. eBay has a highly sophisticated infrastructure that enables global scale of operations without any disruptions. At any given time it has more than 800 million live listings and in 2015, about 59 per cent of transactions between users on Marketplace and StubHub platforms take took place outside of the US[1]. The presence of such an advanced global infrastructure can play an instrumental role in terms of achieving global market penetration of new products and services in an effective manner. Interbrand and Forbes estimate eBay brand value as USD 13.9 billion and USD…

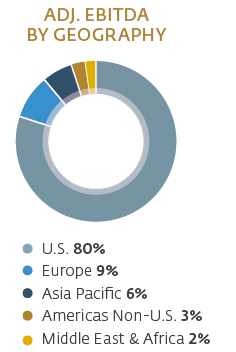

SWOT is an acronym that stands for strengths, weaknesses, opportunities and threats related to businesses. The following table illustrates Hilton SWOT analysis Strengths 1. Extensive experience and a vast scope of the business 2. Effective customer retention schemes 3. strong property portfolio 4. Strong and effective leadership by Christopher Nassetta 5. A high level of service customatisation achieved via technological integration Weaknesses 1. Overdependence on the US market 2. High levels of debts 3. Little global market share, despite the large portfolio of brands 4. Lack of flexibility due to its large size Opportunities 1. Further International market expansion 2. Formation of strategic alliances 3. Focusing on research and development 4. Establishing presence in the mid-level budget hotel sector Threats 1. Threat of terrorism and political instability 2. Adverse changes in macroeconomic climate 3. Ethics-related issuesin Hilton hotels 4. Loss of key talent and key personnel Hilton SWOT analysis Strengths 1. Hilton Worldwide comprises 13 brands including well-known brands such as Hilton Hotels and Resorts, Waldorf Astoria, Conrad, Double Tree, Embassy Suites and others. Hilton Worldwide served more than 140 million guests in more than 100 countries and territories in 2015 alone.[1] Due to the large scope of its business operations, the company benefits from the economies of scale to a considerable extent, creating the potential for further growth of the business. 2. Hilton offers one of the best customer loyalty schemes in the industry represented by Hilton HHonors program. Wide range of benefits offered by the program includes discounted prices, digital check-in, free internet access, late check-out and others. These benefits are greatly appreciated by customers and there are more than 50 million Hilton HHonors members worldwide.[2] 3. Hilton Worldwide owns 4610 properties around the globe.[3] An extensive property ownership is a major strengths from the financial point…

Red Bull SWOT analysis facilitates a critical assessment of strengths, weaknesses, opportunities and threats related to the energy drink manufacturer. The following table illustrates Red Bull SWOT analysis: Strengths 1. Market leadership in the global scale 2. Increasing popularity in emerging markets 3. Strong and visionary leadership by Dietrich Mateschitz 4. Solid financial position Weaknesses 1. Red Bull products considered to be unhealthy 2. Limited range of products 3. Expensive price 4. Concentrated production facilities Opportunities 1. Enhancing nutritional aspects of beverages 2. Further increasing presence in media via strategic collaborations 3. Engaging in product diversification 4. Increasing focus on CSR Threats 1. Negative health implications due to the consumption of Red Bull products 2. Increase in marketing costs 3. Further intensifying competition 4. Lawsuits against the company due to consumer health deterioration Table 1 Red Bull SWOT analysis Strengths Red Bull is sold in more than 169 countries and about 60 billion cans of Red Bull have been consumed so far. The company sold more than 5.9 billion of cans in 2015 alone.[1] Market leadership in the global scale is an indication of a considerable strength from the viewpoint of the brand equity and consumer loyalty. Red Bull is engaged in international market expansion with a focus on emerging markets in an aggressive manner. In 2015, Red Bull sales in Turkey, South Africa and India increased by 25 per cent, 19 per cent and 18 per cent respectively.[2] The current strategy of increasing presence in developing countries is set to contribute to the long-term growth prospects of the business. Dietrich Mateschitz is a proven visionary leader who had to deal with multiple obstacles during his pursuit of making Red Bull an undisputed market leader in energy drink segment around the globe. Innovative ideas of Dietrich Mateschitz for the…

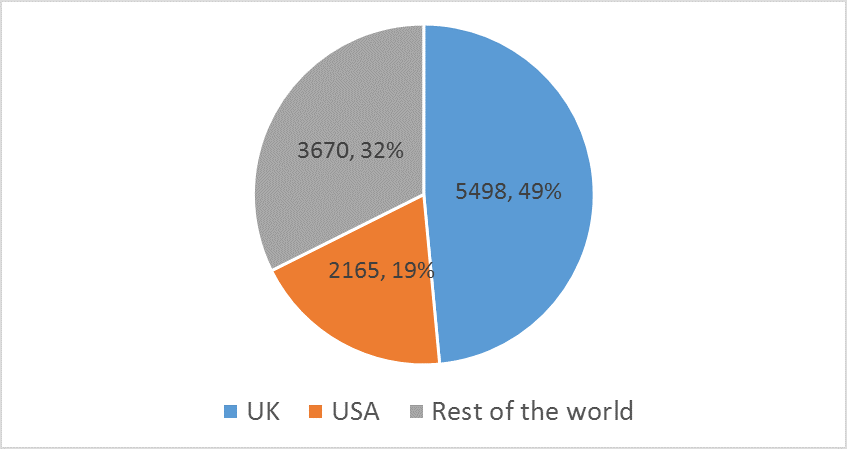

British Airways SWOT analysis is a strategic analytical tool that facilitates the analysis of strengths, weaknesses, opportunities and threats related to the business. The following table illustrates British Airways SWOT analysis: Strengths 1. Economies of scale due to its large size 2. Strong brand image 3. Market leadership in the UK 4. High level of service digitalization and effective integration of IT and internet Weaknesses 1. Overdependence on the UK market 2. Low return on invested capital (ROIC) 3. Constrained capacity of Heathrow airport 4. Lack of experience of the new CEO Alex Cruz in leading the premium segment airline Opportunities 1. Formation of strategic cooperation with other businesses in airline and catering industries 2. International market expansion 3. Benefiting from synergy via Closer integration between IAG’s operating airlines 4. Improving relations with unions Threats 1. Further intensification of competition 2. Terrorist attacks 3. Service distuptions due to employee strikes 4. Escalation of the conflict with the UK government British Airways SWOT analysis Strengths 1. British Airways flies to more than 400 destinations worldwide and its parent company International Airline Group (IAG) also owns Iberia, Vueling and Aer Lingus airlines. Thanks to the extensive scope of its operations, the business benefits from the economies of scale to a great extent. This benefit is used to further strengthen the airlines’s competitive advantage via investments in new advanced fleets and achieving a greater personalization of service provision. 2. The airline enjoys a strong brand image. In 2016 British Airways won both the Business and Consumer Superbrands awards for the second year running – the first company ever to do so. In 2015, British Airways was named by The Sunday Times and National Geographic named as best short-haul and long-haul airline. Moreover, Independent awarded British Airways the title of best European airline, while…

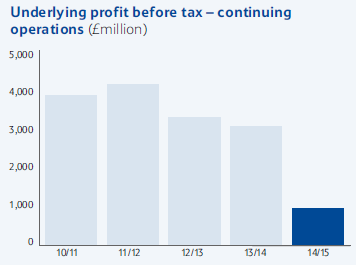

SWOT is an abbreviation that is interpreted as strengths, weaknesses, opportunities and threats related to businesses. The table below illustrates the main points of Tesco SWOT analysis: Strengths 1. Leadership position in the UK 2. Effective online operations 3. Clubcard as an effective consumer information tool 4. Strong property portfolio Weaknesses 1. Weak financial performance 2. Serious damage to the brand image due to commercial income scandal in 2015 3. Reliance on the UK market 4. Diminished employee morale Opportunities 1. Pursuing international market expansion strategy 2. Increasing presence in financial services industry 3. Increasing non-food retail range 4. Enhancing the effectiveness of the marketing strategy Threats 1. Inability of the new leadership to turn over the business 2. Inability to sustain cost leadership competitive advantage 3. Currency fluctuations 4. Emergence of new ethics-related problems Tesco SWOT analysis Strengths 1. Tesco is the biggest retailer in the UK with a grocery market share of 27.9 per cent. Its closest competitor Sainsbury’s has the market share of only 16.6 per cent and the market share of Walmart-owned ASDA is equal to 16.4 per cent.[1] Possessing the largest market share is an important strength regardless of the industry and this position allows Tesco to generate substantial revenues, given it addresses 7Ps of marketing mix in an appropriate manner. 2. The company utilizes online sales channel with a high level of efficiency. Tesco was among the first retailers in the UK to successfully implement online sales channel and currently, revenues generated via online sales account for a solid share of the total revenues. Specifically, in 2015 Tesco online grocery market grew ahead of the market at 20 per cent although the company posted pre-tax loss of GBP 6.37 billion during the same year.[2] The growth of online sales ahead of the market despite…

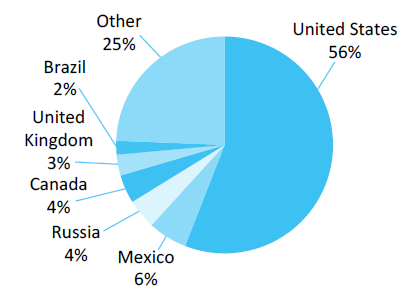

SWOT analysis is one of the most popular strategic analytical tools that used for strategic decision making. The acronym stands for strengths, weaknesses, opportunities, and threats associated with a particular business. PepsiCo SWOT analysis is presented on table below: Strengths 1. Large, yet focused brand portfolio in food, snack and beverage industry. 2. Strong leadership from CEO Indra Nooyi 3. High level of customer loyalty for most of the brands within product portfolio 4. Extensive experiences in mergers and acquisitions 5. Integrated supply-chain and distribution practices across PepsiCo brands Weaknesses 1. Overdependence on domestic market in the USA 2. High level of dependence on large supermarkets such as Wal-Mart 3. “Aquafina” tap water scandal and product recall cases 4. PepsiCo brand perceived as ‘unhealthy’ 5. No presence outside of food, snack and beverage industry Opportunities 1. Improving health implications of products 2. Business diversification into other industries 3. Increasing presence in emerging economies 4. Increasing the effectiveness of CSR strategy 5. Focusing on research and development Threats 1. Intensification of competition 2. Rapid decline in the sales of carbonated drinks 3. New product recalls due to quality scandals 4. High amounts of sugar or salt in products being criticized by government and non-government health organizations PepsiCo SWOT analysis Strengths 1. PepsiCo portfolio is large and it comprises 22 brands in food, snack and beverage industry.[1] Despite the large number of companies it contains, PepsiCo product portfolio can be described as highly focused because of the uniformity of product positioning across the whole portfolio. According to marketing messages, the consumption of all products within PepsiCo portfolio is associated with being active and dynamic and enjoying life to the full extent. Such a uniformity in product positioning provides significant advantages to PepsiCo in terms of promoting its products in an efficient manner despite…

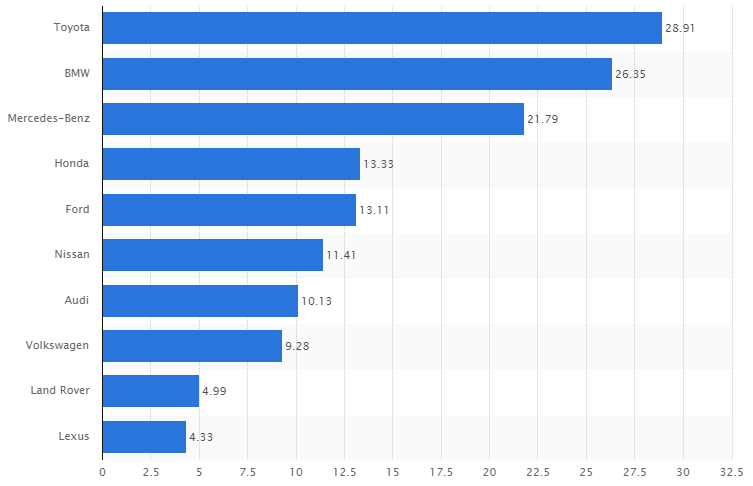

SWOT analysis can be described as “a technique for focusing an individual’s or group’s attention on strengths, weaknesses, opportunities and threats. It is useful particularly because strengths and weaknesses can be the cause of potential future risks – both opportunities and/or threats” (Murray-Webster, 2010, p.88). The following table illustrates BMW SWOT analysis: Strengths 1. Strong brand image 2. Highly automated driving experience and advanced features and capabilities 3. Strong performance of Financial Services Segment 4. Strong CSR performance 5. Reliability of vehicle Weaknesses 1. High level of vulnerability to the future economic crises due to premium pricing strategy 2. Lack of strategic partnerships compared to the competition 3. Weak BMW brand portfolio with only three brands: BMW, MINI, and Rolls Royce 4. Lack of operational cost efficiency 5. Damage to the brand image due to air bag issue Opportunities 1. Increasing revenues through more emphasis on electromobility 2. Formation of strategic alliances with other automobile companies 3. Launch of BMW 9 Series generation 4. Increasing presence in Chinese market 5. Engaging in product diversification Threats 1. Further increases on the prices of raw materials 2. Emergence of new competition from emerging economies 3. Negative impacts from exchange rate fluctuations 4. Damage to the brand image due to malfunctions 5. Loss of talent and key personnel to competitors BMW SWOT analysis Strengths 1. BMW is a highly reputable brand with strong brand image with is associated with efficiency and prestige. As it is illustrated in Figure 1 below, BMW is the second most valuable brand in automobile industry after Toyota with an estimated brand value of USD 6.35 billion. High brand value is a considerable strength for any business as it is a convincing indicator of a high level of consumer loyalty. Figure 1 Automobile brand values in billion…

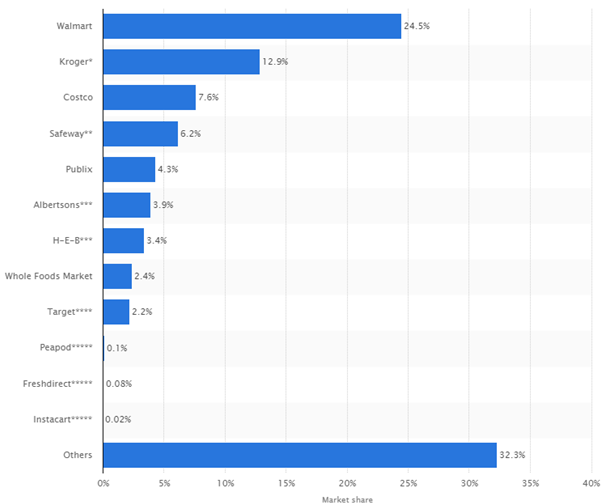

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. The following table illustrates Walmart SWOT analysis: Strengths 1. Efficient utilization of online sales channels 2. Huge financial resources 3. Leadership position in the US 4. Sophisticated supply chain operations 5. High brand value Weaknesses 1. Low profit margin 2. Brand image damaged by a series of scandals 3. Lack of flexibility due to its large size 4. Business model easy to replicate Opportunities 1. Further international market expansion 2. Formation of strategic alliances 3. Vitalizing CSR programs and initiatives 4. Exploring diversification opportunities Threats 1. Failure to sustain cost advantage 2. Eruption of quality-related or ethics-related scandals 3. Negative impact to revenues from currency fluctuations 4. Risk of a new global economic crisis Walmart SWOT Analysis Strengths 1. Walmart has an impressive online presence. There are 11 countries with a dedicated Walmart e-commerce websites and the total e-commerce sales increased by 22 per cent in 2015, and about 75 percent of walmart.com sales come from non-store inventory[1]. Moreover, in Brazil, Walmart’s online assortment, including from marketplace partners grew 10 times and in China, Yihaodian saw traffic increase more than 60 percent in 2015[2]. Such a solid presence in online platform and an efficient utilization of online sale channel is a significant strengths that immensely contributes to Walmart’s core competitive advantage of cost leadership. 2. Walmart’s consolidated revenues during the fiscal year of 2015 equaled to USD 486 billion and free cash flow of more than USD 16 billion was generated during the same period[3]. This amount is more than the revenues of the following four companies combined—Costco, Kroger, Tesco in the United Kingdom, and Carrefour SA in France. Walmart’ AA credit rating, which is rare in retail further contributes to the financial strengths of the company. In other…

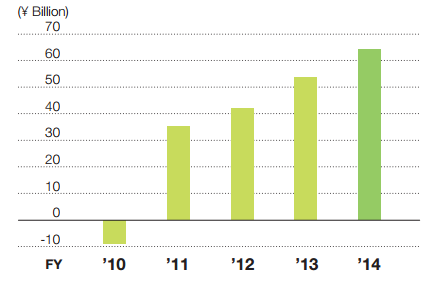

SWOT is an acronym for strengths, weaknesses, opportunities and threats related to organizations. You can learn the theory of SWOT analysis here. The following table illustrates Toyota SWOT analysis: Strengths 1. Solid financial position 2. Toyota Production System (TPS) 3. Advanced technological features and capabilities 4. Leadership position and brand value Weaknesses 1. Extensive dependence on Japan and North American markets 2. Passenger safety issues in the past and product recalls 3. Weak presence in emerging markets 4. Lack of flexibility due to large size Opportunities 1. Investments in automated driving technology 2. Business diversification 3. Focus on developing countries 4. Further concentration on electric cars Threats 1. Passenger health and safety issues 2. Fluctuations in the prices of fuel 3. Emergence of innovative competitors 4. Increase in the prices of raw materials Toyota SWOT analysis Strengths 1. Generating revenues of ¥25.6919 trillion, which is an increase of ¥3,627.7 billion, or 16.4%, compared with the prior fiscal year,[1] Toyota possesses massive financial resources. As it is illustrated in Figure below, amid intensifying competition and increasing global economic uncertainly, the net operating income of Toyota has been consistently increasing for the last five years. The current solid financial position of the company contributes to its competitive advantage via granting opportunities to engage in research and development to a greater extent. Changes in Toyota’s net operating income[2] 2. Toyota Production System (TPS) is a widely recognized system for its efficiency in elimination of waste, irregularities, and overburdening from the production process. Based on two fundamental concepts of jidoka (automation with a human touch) and Just-in-Time principle, this system has enabled Toyota to adopt a proactive approach in dealing with manufacturing issues, at the same time saving significant manufacturing costs. Additionally, Toyota has introduced and perfected manufacturing concepts of Kaizen (continuous improvement) and…