Search results for: Mckinsey 7s

PESTEL is a strategic analytical tool and the acronym stands for political, economic, social, technological, environmental and legal factors. Netflix PESTEL analysis involves the analysis of potential impact of these factors on the bottom line and long-term growth prospects of the popular streaming platform. Political Factors in Netflix PESTEL Analysis There are many political factors that can affect the financial performance of on-demand streaming services such as Netflix. These factors include government stability, trade union activities, bureaucracy and government tariffs. Moreover, corruption, trade controls and the freedom of press also belong to the list of political factors with a potentially significant impact on entertainment services providers. Leaving a market because of war Netflix was indirectly affected by Vladimir Putin’s invasion of Ukraine. Having entered Russian market in 2016, the largest streaming service in the world announced on March 6, 2022 the suspension of its services, projects and acquisitions in the country. Leaving the country within 10 days after Putin declared war in Ukraine was an act of solidarity with Ukraine and other global brands suspending their operations in Russia. At the same time, Netflix had no other choice, because had the company remained in Russia its brand image would have suffered significantly with negative implications on the stock price. Government restrictions Apart from Russia, China is the only country where Netflix is not available. Although they dress it otherwise, the Chinese government has banned the popular streaming platform because they don’t want their citizens to be influenced by western culture. In other words, Chinese authorities fear that a wide range of shows and programs available on Netflix may influence the population and they might become more difficult to control. Taking into account the massive size of Chinese market, not being allowed to operate in the market is…

SWOT is an acronym for strengths, weaknesses, opportunities and threats for organizations of all types. The following table illustrates Netflix SWOT analysis: Strengths 1. First mover advantage 2. Corporate culture 3. Original content 4. Global presence Weaknesses 1. Dependence of business model on other companies 2. High level of indebtedness 3. Over-dependence on North American home market 4. Compromised customer service Opportunities 1. Forming strategic partnerships 2. Product line extension 3. Benefiting from AI 4. Increasing focus on locally adapted content Threats 1. Failure of new co-CEOs 2. Video piracy 3. Loss of customers due to rising prices 4. Global market saturation Netflix SWOT Analysis Strengths in Netflix SWOT Analysis 1. Although Netflix did not invent on-demand video streaming, it has proved that this business model can be viable. Netflix was the first company to scale video streaming globally and the company name has become synonym for subsection based on-demand media with huge content library. First mover advantage is a considerable strength for Netflix because it increases brand recognition considerably and establishes the company’s serves as industry standards. 2. Netflix is famous for its non-orthodox corporate culture. The entertainment services provider encourages decision-making by employees at all levels and shares information openly, broadly and deliberately. Moreover, internal communications at the largest streaming service in the world are candid and direct and this also relates to employee performance feedback. Sophisticated corporate culture established by co-founder and former long-term CEO Reed Hastings has played an integral role in the success of the company and it is one of the formidable strengths associated with the business. 3. Netflix was among the first streaming platforms to produce its own content starting from 2011. Over the years the entertainment services provider was able to produce critically acclaimed shows worldwide such as House…

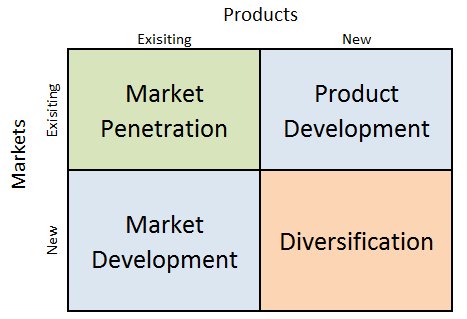

Netflix Ansoff Matrix is a marketing planning model that helps the largest streaming service in the world to determine its product and market strategy. Ansoff Matrix illustrates four different strategy options available for the on-demand media provider. These options are market penetration, product development, market development and diversification. Ansoff Growth Matrix Within the scope of Ansoff Matrix, Netflix uses all four growth strategies in an integrated way: 1. Market penetration. Market penetration refers to selling existing products to existing markets. Netflix engages in market penetration through an effective marketing strategy. The entertainment services provider targets outward-looking, affluent consumers with international credit cards and smartphones and uses anticipatory and mono-segment positioning to appeal to the needs and preferences of this segment. 2. Product development. This strategy involves developing new products to sell to existing markets. Product development is one of the main growth strategies for Netflix. The company is focused on producing original content. Furthermore, the streaming service is developing a growing number of non-English language originals from places such as Mexico, France, Italy, Japan and Brazil, to name just a few. 3. Market development. Market development strategy is associated with finding new markets for existing products. The on-demand media provider uses market development growth strategy extensively since its inception in 1998. Thanks to the successful implantation of this strategy, today Netflix is available virtually everywhere except in China and Russia and it has 231 million paid memberships in over 190 countries. [1] 4. Diversification. Diversification involves developing new products to sell to new markets and this is considered to be the riskiest strategy. The largest streaming service in the world uses diversification growth strategy rarely. Entering into gaming sector in 2021 is the only notable business diversification case for Netflix. Netflix Inc. Report contains the above analysis of Netflix Ansoff…

Netflix organizational culture integrates the following five key elements: 1. Encouraging decision-making by employees. The entertainment services provider encourages employees at all levels to take initiative and resolve issues on their own with minimum input from their superiors. Decision making at the on-demand media provider is made by individuals, referred to informed captains, rather than by teams or committees. Informed captains are experts in their area who listen to the viewpoints of other people and then make decisions on their own. Thanks to this principle Netflix doesn’t have to wait for consensus or vote by the committee and this is huge advantage taking into account highly dynamic nature of the external environment. 2. Sharing information openly, broadly and deliberately. Netflix has taken a radical approach towards information sharing. The largest streaming service in the world maintains online memos in narrative form for members of board of directors that not only include links to supporting analysis but also allow open access to all data and information on the company’s internal shared systems. This is unprecedented for a global corporation. Unlike, some other tech companies such as Apple, employees at all levels of the streaming service have access to all internal information. Access to data helps Netflix employees to make more informed decision making. Moreover, thanks to the access to information employees feel trusted and become more responsible at their job. 3. Communicating candidly and directly. Openness in communication is one of the pillars of Netflix organizational culture. Candid and direct communication also relates employee performance feedback. Openness has been ingrained into the culture of Netflix to such a degree that not speaking up one’s mind can be easily perceived as an act of disloyalty. 4. Keeping only our highly effective people. The streaming service models itself on being a…

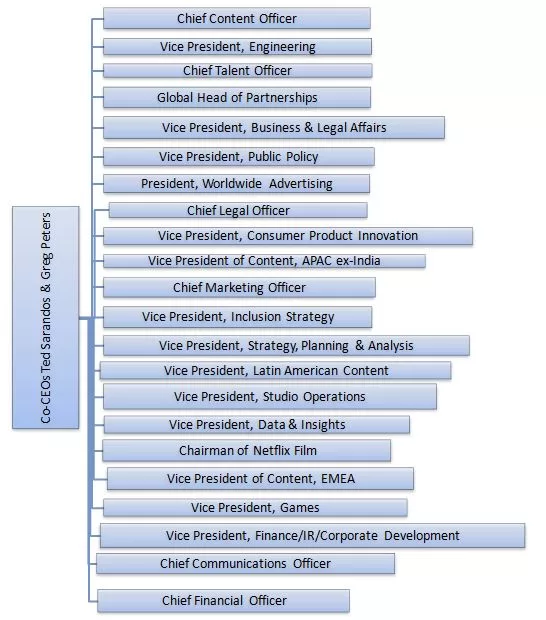

Netflix organizational structure can be classified as relatively flat. This is an unconventional for a multinational giant that employs more than 12500 people in offices in over 25 countries[1]. Fewer management layers increases the span of control for each manager. Corporate structure of Netflix can also be described as unitary or u-form. In companies with unitary structure the business is managed as a single unit and it has functional lines such as sales, marketing, engineering etc. Flat and unitary aspects of corporate culture of Netflix offers a range of advantages for the the entertainment services provider. Specifically, less hierarchy ensures faster and better communication among employees at all levels, thus increasing the speed and quality of decision making. This is critically important taking into account increasingly dynamic nature of the external marketplace and the need for the company to adapt quickly. Netflix organizational structure had to change early in 2023 when co-founder Reed Hastings stepped down from the role of CEO. Nevertheless, the flat and unitary nature of the organizational structure has remained. Moreover, even though Reed Hastings is no longer CEO of the on-demand media provider, he remains as the ultimate decision maker on the strategic issues. This arrangement may prove to be practically helpful whenever there is a disagreement between current co-CEOs Ted Sarandos and Greg Peters. Netflix Organizational Structure Netflix Inc. Report contains the above analysis of Netflix organizational structure. The report illustrates the application of the major analytical strategic frameworks in business studies such as SWOT, PESTEL, Porter’s Five Forces, Value Chain analysis, Ansoff Matrix and McKinsey 7S Model on Netflix. Moreover, the report contains analyses of Netflix leadership, business strategy and organizational culture. The report also comprises discussions of Netflix marketing strategy, ecosystem and addresses issues of corporate social responsibility. [1] ESG Report (2022)…

Co-founder Reed Hastings had the helm of Netflix leadership as the CEO for a quarter century until he stepped down early in 2023. Hastings practiced unconventional and effective leadership practices such as providing context instead of directions, offering straightforward feedback and paying people more than they expect. Under Reed Hastings, leadership at Netfix largely boiled down to hiring and retaining top talent and remaining innovative largely because of the company’s commitment to hiring high performers, giving them lots of transparency and freedom, and avoiding imposing rules that might get in their way. Currently, there are two Co-Chief Executive Officers – Ted Sarandos and Greg Peters. Sarandos had led Netflix’s Hollywood business for many years and Peters has managed advertising business of the the streaming service. The rationale behind having two CEOs relates to benefiting from the shared expertise of the two executives. There are cases such as Oracle, Salesforce and Atlassian where companies thrived under joint CEOs. At the same time, having two CEOs managing a company can involve certain challenges such as blurring the line of responsibility, lack of speed of decision making and high potential of ego issues and others. These are valid reasons why majority of companies have lone leaders. Moreover, many business analysts and practitioners argue that joint CEOs are only temporary measure mostly suitable only for start-ups. However, to the credit of Netflix, co-founder and former CEO Reed Hastings has not left the company and he is serving as executive chairman. In case if major disagreements occur between Sarandos and Peters regarding strategic issues Hastings can always jump in with the final voice regarding the issue. An interesting aspect of leadership at Netflix refers to the depth of information provided to board members and the level of engagement of the board members with…

Fundamental Analysis of Netflix Stock Fundamental analysis refers to the practice of using financial activity to forecast stock prices. Revenue: Netflix’s revenue has been growing steadily in recent years, reaching USD30.9 billion in 2022. Earnings per share: Netflix’s earnings per share have also been growing steadily, reaching USD9.36 in 2022. Free cash flow: Netflix’s free cash flow has been positive in recent years, reaching USD10.7 billion in 2022. Debt: Netflix has a moderate amount of debt, with a debt-to-equity ratio of 1.3. Margins: Netflix’s margins are high, with a gross margin of 73% and an operating margin of 22%. Valuation As of September 11, 2023 Netflix’s stock is trading at a price-to-earnings (P/E) ratio of 37.05. This is higher than the P/E ratio of the S&P 500, which is currently at 21.08. However, Netflix’s P/E ratio is lower than its historical average of 50. Technical Analysis of Netflix Stock Technical analysis is the reliance of historical stock price activity to predict future price activity. As of September 11, 2023 Netflix stock (NFLX) is trading at USD442.80. The stock has been on a downward trend since January 2023, but it has been consolidating in recent weeks. The 50-day moving average is at USD432.97, and the 200-day moving average is at USD352.07. The relative strength index (RSI) is at 57.74, which is in the neutral zone. Technical indicators The moving average convergence divergence (MACD) indicator is positive, which is bullish. The MACD line is above the signal line, and the histogram is rising. The stochastic oscillator is also positive, and it is rising towards the overbought level. Support and resistance levels The nearest support level is at USD419.81, followed by USD402.99. The nearest resistance level is at USD453.45, followed by USD472.70. Sentiment Analysis of Netflix Stock Sentiment analysis is the process of determining the emotional…

Netflix business strategy is to continuously improve its members’ experience by offering compelling content that delights them and attracts new members. Netflix pioneered subscription streaming in 2007 and retains the first mover competitive advantage in this segment. Moreover, the largest streaming service in the world is pursuing the following strategies: 1. Focusing on revenues maximization over membership growth. Internet-based technology companies such as Netflix often have to choose between growing members or revenues. On one hand, brand recognition at a broad scale requires scaling of the business. On the other hand, scaling requires massive financial investments at the same time when you cannot increase the cost. If you increase the cost, you cannot scale because people will not purchase. This is why internet-based companies such as Uber and Airbnb traded revenues for membership growth and stayed unprofitable for a long time. For Netfix, on the other hand, membership growth is important, but revenue maximization per member is their primary concern. The on-demand media provider regularly increases prices. In the latest move it eliminated its cheapest USD 9,99 add-free plan for its US-based subscribers and the cheapest ad-free tier for new members is because USD15.49 per month in summer 2023.[1] 2.Investing in original content. Netflix is the first company to invest in original content starting with award-winning House of Cards series in 2011. This was followed by a series of quality original content such as BoJack Horseman (2020), Squid Game (2021), Kipo and The Age of Wonderbeasts (2020), Arecane (2021) and many others. Quality original content is one of the main competitive advantages for the on-demand media provider. 3. Staying focused on movies, series and documentaries. Netflix stays within its niche of movies, series and documentaries and the company is planning to continue with this strategy for the foreseeable future. The…

Netflix Inc., the largest streaming service in the world, was incorporated on August 29, 1997 and began operations on April 14, 1998. The entertainment services provider has 231 million paid memberships in over 190 countries. The company employs about 12,800 people in more than 25 countries. Consolidated revenues for the year ended December 31, 2022 increased 6% as compared to the year ended December 31, 2021, due to the 6% growth in average paying memberships and a 1% increase in average monthly revenue per paying membership. Netflix business strategy involves prioritizing revenues maximization over membership growth and increasing investments on original content. Moreover, the streaming service has decided to stay focused on movies, series and documentaries not entering news and live sports segments. The on-demand media provider had change of leadership in 2023 with co-founder Reed Hastings stepping down from the role of co-CEO and Ted Sarandos and Greg Peters becoming new co-CEOs. The largest streaming service in the world has flat organizational culture and its organizational culture has been a subject of case studies in business schools for its unconventionality and effectiveness. Specifically, Netflix organizational culture effectively encourages decision making by employees at all levels and the company has taken information sharing to a whole new level. The popular streaming platform despises rules and communication practices there are candid and direct. Along with its obvious strengths such as first mover advantage, quality original content and global presence, the entertainment services provider has certain weaknesses as well. Namely, Netflix has high level of indebtedness and its business model depends on other companies. Furthermore, the company is over-dependent on North American home market and there is a room for improvement on its customer services. Netflix Inc. Report contains the application of the major analytical strategic frameworks in business studies such as…

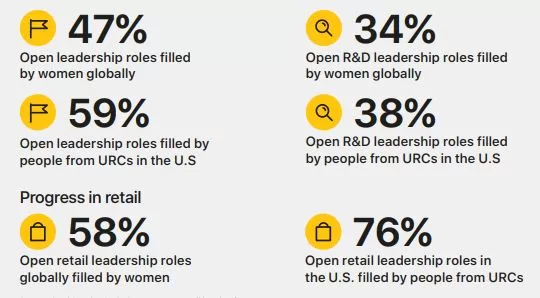

Apple corporate social responsibility (CSR) programs and initiatives are led by Lisa Jackson, Vice President for Environment, Policy and Social Initiatives, reporting directly to CEO Tim Cook. More than 1 million people work in Apple supplier facilities and as such, the company’s operations have considerable implications on the society. It has to be noted that “Steve Jobs wasn’t known for philanthropy. Some wondered if he made anonymous donations to charity, some criticized him for his lack of public giving, while others defended him”[1]. However, with Tim Cook assuming Apple leadership in 2011, the focus on CSR aspect of the business has increased to a considerable extent. Tim Cook is a member of Paulson Institute’s CEO Council for Sustainable Urbanization, working with other CEOs of top Chinese and Western companies to advance sustainability in China. Apple Supporting Local Communities In Oregon, USA, Apple partners with Bluestone Natural Farms to transform compostable materials generated onsite into rich organic material for use on the farm. The tech giant launched a 100-kilowatt rooftop solar project at an educational premise for disadvantaged children in Philippines. The company added 50-kilowatt solar power system and a 260-kilowatt-hour battery to supply clean electricity to off-grid fishing community in Thailand. Apple Educating and Empowering Workers The multinational technology company provided training courses to about 4 million people since 2008. The tech giant has competitive employee benefits practices. For example, expectant mothers can take up to four weeks before a delivery and up to 14 weeks after a birth, while fathers and other non-birth parents are eligible for up to six weeks of parental leave. Apple suppliers paid back USD 32.2 million recruitment fees to their 36,599 employees since 2008. The iPhone maker taught employees organized 185,000 hours of inclusion and diversity training in 2021[2] The company organized 80,000 hours of management…